Will Latin

America Repeat Africa’s Oversupply

Situation?

Oct 5th, 2014 by

Prashant

Butani, NSR

Why Compare

The Two?

At

first this seems like an unusual combination

of continents to compare and contrast.

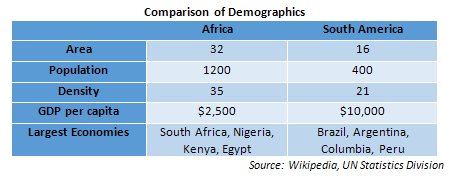

Africa is about three times the population

of South America, twice the area and more

than one and half times more dense in terms

of people per square kilometre. South

America on the other hand, has a GDP per

capita that is almost four times that of the

African continent. Yet, both regions have

contributed

one country each

to the BRICS viz. Brazil and South Africa.

Both continents have close ties to their

northern counterparts (Europe and North

America) in terms of language, video

distribution platforms and connectivity.

Both continents have also

played host to

the FIFA World Cup,

an event known to attract viewers – and

hence consumption of satellite capacity –

from across the globe. However, what makes

the comparison interesting is that while

Africa has seen almost all satellite

operators launch capacity for the region

over

the last 5 years;

for South America that phase of a “supply

boom” is expected to play out over

the next

half decade.

A fact that warrants the question above –

will this amount to over capacity, excessive

competition and eventually, falling prices

(read lower revenues & margins)?

Are There

Trends Behind The Launches?

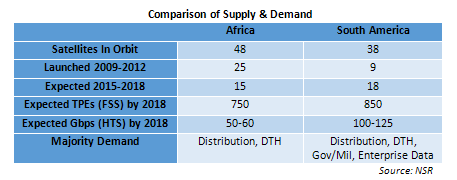

For

starters, Africa has about 48 satellites in

service currently carrying C-band and/or

Ku-band capacity in the 50 West to 95 East

orbital arc that allows fairly decent look

angles into the continent. For South

America, albeit a smaller region, that

number for its orbital arc is about 38

satellites in service. Now that may suggest

nothing extraordinary but of those numbers,

between 2009 and 2012, a span of only 4

years, there were about

25 launches over

Africa whereas the number for South America

was merely 9 satellites.

Clearly, the operators had decided that

there was a gap left by fibre in the African

market that only satellite could help fill.

What they perhaps had not anticipated was

that the near monopoly in the video

distribution markets in Africa would not

change drastically and that VSAT operators

would eventually consolidate as fibre became

more prevalent. All this while, more and

more operators laid their claim to

the

promise of Africa

thus leading to increased competition and

eventually lower fill rates and falling

prices.

South America, on the

other hand, becomes the region in focus if

you now look at how much capacity is coming

online in the next 3-5 years. There are

about 18 satellites announced for South

America carrying either C / Ku or HTS

capacity whereas the figure for Africa is

about 15. In terms of TPEs of C, Ku and

Ka-band capacity, South America is expected

to add about 850 TPEs by 2018 as compared to

only 750 for Africa by the same period. The

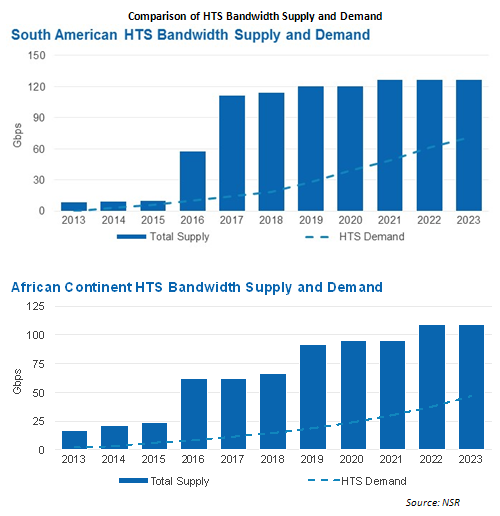

difference becomes extremely evident when

one looks at only HTS capacity, measured in

Gbps. Here, the figure for

South

America is at 100-125 Gbps by 2018 as

compared to only 50-60 Gbps for Africa.

Now this figure does include Brazil’s SGDC-1

which is not entirely a commercial payload

but that does not rule out its role in

Digital Divide programs. So despite all the

“unconnected” markets that Africa offers

compared to a more robust fibre network for

South America, effectively the HTS capacity

coming online for data services is just

under half!

What Does

This Discrepancy Mean?

For

starters, one must take into account that

South America is benefiting from the lessons

learned on HTS systems in other parts of the

world, namely North America and Europe. The

applications are largely data driven and

even there, more suitable for consumer

broadband. As an application, that has

demanded a

higher purchasing

power and disposable income

from the population that lives beyond the

reach of terrestrial solutions. At $10,000

GDP per capita for South America versus

$2,500 for Africa, it now begins to seem

obvious why there are fewer HTS birds for

the latter. In addition, the geo-political

climate in South America is one of a large

dominant economy (Brazil) versus 2-3 growing

economies (South Africa, Kenya, Nigeria)

that make the former region perhaps

easier to

navigate

for those launching HTS-based services.

Also, the video markets in Africa remain

somewhat closed with MultiChoice still

maintaining incumbent status and smaller

players yet to gain significant ground.

South America offers a

much more vibrant

DTH market

and with penetration rates of digital TV

still low the potential headroom is still

attractive. All of these factors point

towards there being more easily addressable

demand, and hence more supply, for the South

American market.

Does More

Supply Mean Excess Supply?

This, then becomes the multi-million dollar

question as to whether South America will

suffer the same fate as Africa in the longer

term with excess supply. The

supply over

Africa has been, and will be for some time,

largely FSS

i.e. traditional wide beam C, Ku and

Ka-band. This is suited for both video and

data markets and while it typically means

higher cost per bit for data, there have

been players like Yahsat and Avanti that

have brought arguably cheaper Ka-band

capacity into the African data market.

Despite this, fill rates over Africa remain

low (in the sub-55% range) and are expected

to continue this way until supply additions

slow down. Will South America suffer a

similar fate?

The answer is two-pronged and

varies depending on whether it is video or

data markets one addresses. For video

(effectively FSS supply and demand) South

America seems to be offering enough

opportunities between now and

the 2016

Brazil Olympics.

Even after that inflexion point, there are

enough countries with

Analog

Switch-Over plans

to keep fill rates ticking upwards for the

region on the video side. For data, however,

the answer is not as straightforward. Yes,

there seems to be a

consumer

broadband

market for the taking in the suburban and

remote areas of Brazil and few other

countries. There are even quite a few

USO-driven Digital Divide

programs run by the Government that would be

happy to run on HTS capacity that lowers the

cost per bit. However, and other developed

markets have shown, that Government-backed

rural broadband programs don’t always work

according to schedule. In addition, if there

are too many HTS systems lowering the cost

per bit, then it becomes a problem of plenty

and this is where NSR believes that there

could be over supply in the near term. A

corollary to lowering the cost per bit is,

of course,

opening new

applications and markets

like mobility (aeronautical, maritime or

land-mobile) and video contribution that

could foster demand and stabilize fill rates

in the longer term.

Bottom Line

Yes, if one only looks at launches and

amount of FSS and HTS capacity coming online

it does seem that South America is going

down the same path as Africa. However,

it

may not be as slippery a slope,

because the situation in Africa was

different. Africa saw FSS oversupply as a

result of fibre expansion and geo-political

challenges in markets that had satellite

demand. South America is ahead of Africa

with respect to fibre. Not to say that it

isn’t expanding, but growth in the former is

more evolutionary as major fibre routes

(both land and submarine) were deployed

years ago and the market has absorbed these.

The only caution, that NSR advises operators

in South America actually goes back to

Finance 101 –

Compound

opportunity in the present and Discount

projections of the future.