Time is Money for Electric Propulsion

Aug 6, 2014 by

Stéphane Gounari, NSR

Since the March 2012 deal between Boeing, SpaceX, ABS

and Satmex, no full electric propulsion (EP) GEO Satcom

had been ordered. July 2014 however marked the end of

this dry period with the procurement of SES-12,

Eutelsat-172B and the announcement, by India-based

Aniara, of the procurement of two EP satellites.

These deals illustrate different aspects of the EP

value-proposition. SES-12 will have a mass of 5,300 kg

and a very large payload featuring 54 wide-beam

transponders (36 MHz equivalents) and more than 80

spot-beams. In parallel, its mass means it could be

launched on Falcon-9. By stacking a very large payload

on a 5,300 kg satellite,

SES is truly leveraging every

aspect of EP.

It may use a cheaper launcher, reducing CAPEX, while

getting a very large payload on one satellite,

maximizing the satellite’s capability, thus increasing

its revenue generation capability.

Eutelsat-172B illustrates the same logic. With a mass

of 3,500 kg it will be a fit for the low seat on

Ariane-5,

whose price was recently considerably lowered.

But at the same time, the satellite will carry three

payloads totaling 50 physical transponders and a 1.8

Gbps HTS payload.

In comparison, Aniara’s project is more similar to

Boeing/SpaceX/ABS/Satmex deal. With a unit mass of 1,000

kg, they will each carry around 15 transponders and are

baselined for a launch on GSLV. This project is clearly

focused on launch cost savings but at the expense of

satellite capabilities. Of note, Aniara’s satellites

will be the first GEO satellites manufactured by Dauria

Aerospace, and the GSLV is currently an unreliable

launch vehicle whose next version is still in

development.

The deals illustrate that the value-proposition of EP

GEO satcom is improving as reliability concerns are

addressed, but certain issues will not go away:

- Time is Money: An EP GEO satellite

will take months to reach its destination (4 months

for Eutelsat-172B), and this has a cost: From the

cost to monitor the satellite for months of

maneuvering to the interest on the project

investment as revenue generation is delayed.

- Lack of Reactiveness: Given the

orbit-raising time, an EP satellite is not wholly

reactive, which is a no-go when it comes to

unplanned replacement satellites. This is why EP

will primarily be used for planned replacements.

- Opportunity cost: For extension

projects, addressing new markets, the longer delay

before the satellite is operational means that some

revenues will be lost, and in some cases this could

also give a head-start to a competitor (space or

terrestrial). It will also be an issue for

replacement satellites as they usually address a few

new markets as well.

Bottom Line

As indicated in NSR’s

Satellite Manufacturing and Launch Services, 4th

Edition, electric propulsion for GEO Satcom has

value only when associated with a launch vehicle, be it

to save on costs (such as Aniara satellites), to

maximize the payload within a certain mass-range or to

do both at the same time (such as SES-12 and

Eutelsat-172B). Therefore, the value of EP is entirely

related to the launch services supply, in terms of mass

capability and price; Satellite Operators compare the

negative aspects of an EP-based architecture to the

gains. In the next few years, bigger launch vehicles

such as the Angara-5, Ariane-5ME and Falcon-Heavy will

become operational and will feature lower costs per kg

than today’s launchers. When this happens, the value of

EP will be considerably impacted.

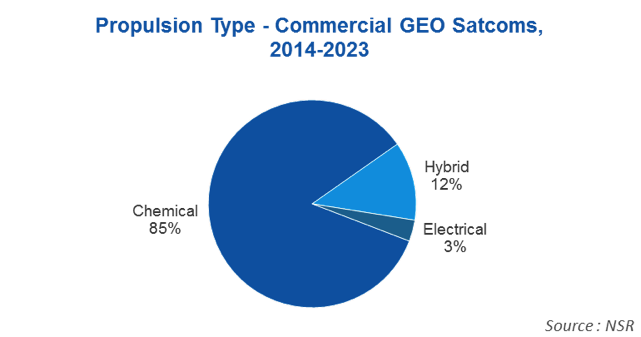

This is why, despite the recent announcements, NSR

does not expect full EP to represent a large share of

the market for the next 10 years.