The Sweet Spot for Ku-band IFEC

Jul 23rd, 2014

As airframe manufacturers keep raising their

20-year global aircraft demand forecast, sifting through the

expectations of which region and what type of aircraft will be

the sweet spot of connectivity is becoming a tricky endeavor.

But looking at manufacturer forecasts, single

aisle passenger jets such as the NG737 and the A320NEO (New

Engine Option) are the fastest growing segment over the next two

decades with Boeing pegging these at 25,700 new units in the

160-seat range. Asia is gaining the most interest for both

Boeing and Airbus as many carriers are buying them by the dozen.

The recent purchase of 50 B737s by China’s 9 Air, Spring

Airlines’ expected order of 30 A320NEOs, or Indonesia’s Lion

Air’s massive order of 234 Airbus A320s and A319s show the pace

of growth in the region. One simply hopes that

overcapacity from these carriers or higher oil prices in the

short-term will not mean cancellations.

Fortunately, Boeing and Airbus orders for

narrow-body units come mostly from North America and Europe

where the busiest short- and medium-haul traffic occurs. It is

also where the market for connectivity has already taken off

with over 680 planes already connected. These planes are

mostly for travel routes below 3 hours, but as airlines extend

their range to leverage their international presence in the face

of stiff competition from low-cost carriers, they are becoming

part of a complete offering whereby connectivity on all routes

and airframes is a major differentiator. Some airlines

such as United Continental and Delta Airlines have contracts in

place to outfit both long-range and regional aircraft with

satellite-based connectivity to do just that.

Already Row44 (Global Eagle) leads Ku-band

satellite-based connectivity in terms of in-service units thanks

to its installs on B737s owned by Southwest Airlines and

Norwegian, which also ordered 100 A320s recently. Row44,

GoGo and Panasonic also won orders from UTair, Icelandair,

AeroMexico, United Continental and WestJet to outfit what NSR

estimates is a backlog of more than 700 narrow-body Ku-band

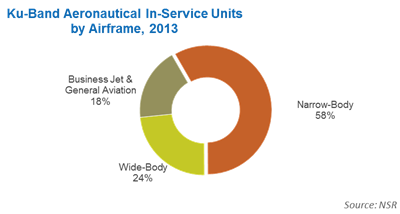

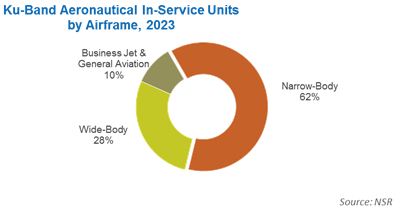

connectivity units in the next 12 to 24 months. As a result, NSR

expects retail revenues from Ku-band units to overtake satcom

equipment revenues sometime in 2016 as ARPUs grow with the

larger installed base.

Bottom Line

Demand for connectivity does not stop at checking

emails or surfing the web, but it is also for delivery of TV,

movies and other content streamed to personal electronic devices

or backseat screens. And to serve content that is

increasingly bandwidth-hungry, Ku-band units are doing the job

(for now). Eventually, the advent of HTS capacity over North

America, the Atlantic Ocean and Europe will displace some VSAT

units on narrow-body aircraft away from Ku-band as more deals

are executed by the likes of ViaSat and Panasonic.

But as revenues from customers of satcom show, and

with more than 700 planes expected to be outfitted by the end of

2016, the sweet spot for Ku-band satellite-based in-flight

connectivity today is narrow-body aircraft in North America and

Europe, and eventually across the rest of the world.