|

Easy Pickings in GEO Launch Services

Jun 11th, 2014 by

Stéphane Gounari, NSR

On May 15, a Proton Breeze-M failed while launching Ekspress-AM

4R, adding to the string of failures and malfunctions affecting

the rocket for several years (six since 2010). Combined with

delays in Arianespace’s launch rhythm and the situation of the

other launch players, the latest failure creates a unique

situation in launch services: while there are too many players

for the market, there is currently a scarcity of reliable and

affordable GEO Launch Services.

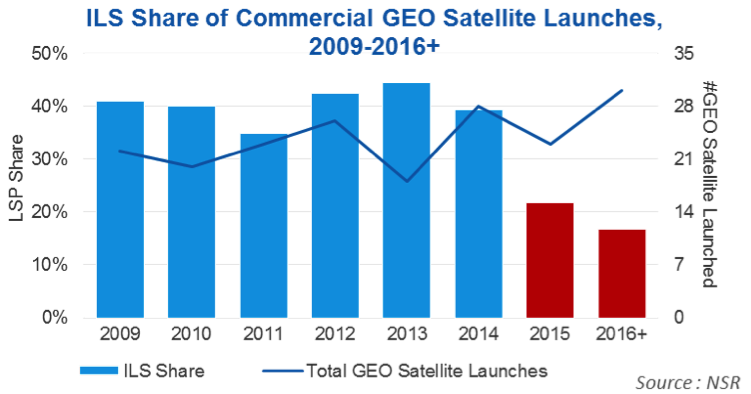

ILS’ backlog was already considerably down before the last

failure, and the latter will make ILS’ potential return to

normal more difficult, providing a welcome window of

opportunities to other providers.

SpaceX saw its backlog of GEO launches grow in the last

years, but it is not yet operating at a fast pace, resulting in

repeated delays and a worrying growing backlog to GEO and other

orbits. Moreover, the Falcon 9 does not have the mass capability

to launch satellites that should have used Proton.

After several years focusing on the U.S. governmental and

military market, Lockheed Martin Commercial Launch Services is

now trying to grow back its share of the commercial market. In

late 2013, it won a commercial contract stating it was able to

drop its costs by 20%. It seems the price is not yet at market

levels as this win was not followed by any other since then, but

it aims at securing one commercial launch per year.

Mitsubishi Heavy Industries (MHI), like Lockheed, is turning

its attention back to the commercial market. Restrained by high

costs and a launch site not ideally located, it is currently

working on an improvement and cost reduction program. MHI

recently received an order from Sky Perfect JSAT, based in Japan

for a launch in 2016. This tends to indicate that MHI’s efforts

are paying off but another order, not from a Japan-based

company, would be the best confirmation. In any case, MHI does

not have a huge launch capability and aims at 3 commercial

missions per year.

Finally, Sea Launch had some difficulties in growing its

market share since emerging from bankruptcy. On May 26, Sea

Launch succeeded in delivering a GTO satellite into orbit. It is

a long awaited success for the firm, and a very well-timed one,

contributing to reinforce Sea Launch’s image as a reliable

provider.

As a direct consequence of this situation, Arianespace’s

backlog of GEO launches has been growing. However, its launch

rate is already at its maximum and the rocket is actually

regularly delayed due to issues with satellite deliveries. This

already caused Arianespace’s low activity level in 2013, and it

is not improving as illustrated by the recent delay of

Measat-3b’s launch from May to September 2014.

Bottom Line

The current situation in the Launch Services market

is a perfect storm that creates scarcity in a market that should

normally be in a position of oversupply. Sea Launch

seems to be in a very good position to take advantage of this

situation, but one should not forget MHI and Lockheed Martin

Commercial Services (although they are both hampered by high

costs). A shortage of reliable launch services places higher

value on their reliability, partially compensating their lack of

competitiveness. If they play their cards smartly, fulfilling

their sales target (3 per year for MHI and 1 for Lockheed)

should prove easy. While Sea Launch does not feature a perfect

reliability score, it is nonetheless at a very decent level and

its availability and price should prove a powerful complement.

Thus, while too many players vie for a piece of the pie, easy

pickings in GEO launch contracts are there for the players with

the right cards.

|