Wireless & Satellite Link-ups Yield Traffic Offload

Benefits

May 28th, 2014 by

Jose Del Rosario, NSR

Traffic offload is a central theme among

mobile operators as they seek to relieve spectrum congestion and

maximize revenue potential, and here, satellite operators appear

poised to play an increasing role in this important market.

Indeed, one of the benefits of the proposed AT&T acquisition of

DirecTV is that the latter can to be used as a video offload

mechanism in managing traffic on heavily burdened terrestrial

wireless networks. A TMCnet article stated that “AT&T,

after a DirecTV acquisition, could at least consider serving up

linear video entertainment by satellite, thus freeing up

bandwidth on the fixed network for high speed access.”

In essence, companies looking at the triple or quadruple play

have to manage voice, data and video traffic and services within

their respective infrastructures.

In the area of offloading mobile Internet

(non-voice) traffic, this has been done to date using Wi-Fi

networks, which has proven to be an effective means for mobile

operators to maintain quality of service and manage the stress

on mobile data networks. However, a recent forecast by

Ericsson indicated that by 2018, more than half of mobile data

or over 7 Exabytes of traffic per month from the current 1

Exabyte will be accounted for by video traffic. Wi-Fi

networks have certainly been used extensively and will likely

continue to be utilized over time.

Yet, the proposition forwarded of additional

benefits within an AT&T acquisition of DirecTV or a wireless

service provider purchasing or incorporating satellite systems

where part of its network infrastructure can act as a video

offload mechanism is certainly worth looking into, especially

given the massive upcoming monthly barrage of video content

consumers and enterprise users will demand in 4-5 short years.

There are a few important points to note:

- The satellite industry is anchored on Video

markets, particularly DTH and Video Distribution due to the

advantage of broadcast economics.

- In the mobile web where video in the form of

data needs to be distributed to multiple sites, i.e. instead

of video headends or DTH dishes, content will need to be

distributed to BTS sites, the same broadcast economic

advantages should apply.

- The massive amounts of data to be offloaded

will need a robust but cost-effective satellite solution,

and here, NSR proposes a low cost/high volume model that can

be achieved using HTS.

- The low cost/high volume model is already at

play in the consumer broadband access segment, and it should

be relatively easy to apply the same business model for

video offload.

- HTS is not and will not be the cornerstone

of a wireless telco’s video offload or traffic offload

strategy, but it can certainly be part of the network

infrastructure, either as a core component or a

complementary layer.

Bottom Line

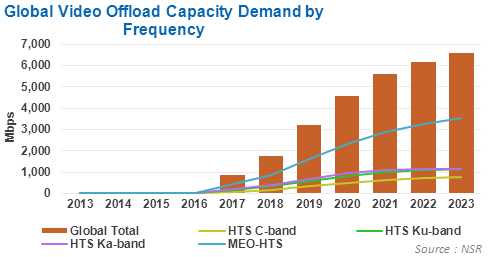

In its recent report, NSR’s

Wireless Backhaul, Trunking and Video Offload via Satellite, 8th

Edition the research findings indicated that the

satellite industry has not yet formulated a solution that

targets the video offload market. Some experiments have

taken place; however, the ROI benchmarks have yet to prove a

business case to fully develop a video offload via satellite

solution.

In NSR’s view, it is not a matter of “if” but

“when” satellite players begin developing technical solutions as

well as signing deals to partner with mobile operators to

specifically address traffic offload issues. A 2017 timeframe is

foreseen by NSR to be the start of the video offload via

satellite market and considers the proposition as a “wildcard”

where traffic and revenue prospects can achieve higher levels of

growth compared to current projections.

|