HTS/MEO-HTS Capacity Drives New

Markets

Feb 19th, 2014 by

Jose Del Rosario, NSR

One of the biggest concerns in the satellite industry today

is that new HTS and MEO-HTS (i.e. O3b Networks) capacity will

severely undercut existing FSS C- and Ku-band transponder demand

for a gamut of broadband satellite markets. Already numerous

operators are claiming severe price pressure on satellite

capacity in different parts of the world and are linking this to

the arrival of new HTS services. Plus more than one operator is

dreading the day they will need to go head-to-head with O3b for

certain services notably in the backhaul and trunking markets.

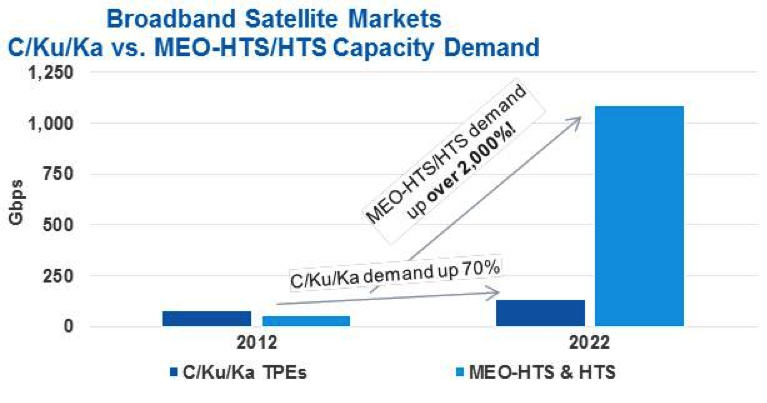

To illustrate the impact of HTS/MEO-HTS capacity leasing on

the overall broadband satellite market, NSR has attempted to

compare its recent forecasts in its Broadband Satellite

Markets 12th Edition study for C/Ku/Ka TPE

leasing to HTS/MEO-HTS leasing directly in terms of Gbps of

leased capacity.

The exhibit illustrates that

there will be a real net increase,

about 70%, in Gbps of classic FSS C/Ku/Ka transponder leasing in

the coming ten years

driven by improving technology and greater capacity provisioning

per provisioned site. Most of the new transponder demand growth

will come for Ku-band capacity mainly in the VSAT networking

market such as in government-backed rural connectivity projects

or for high value, mission critical services.

However, this will

be dwarfed by the more than 2,000% gain in HTS and MEO-HTS

leasing in the coming ten years.

Most of the HTS and MEO-HTS capacity demand growth, over 80%,

will be generated by satellite broadband access services, whilst

the remainder will be driven by a mix of trunking, backhaul and

corporate-class VSAT services.

But, it is critical to note that

MEO-HTS and HTS capacity is priced

much lower per Mbps than classic FSS capacity.

This lower pricing is

essential to opening up new markets, such as satellite broadband

access, as well as keep satellite competitive

for the most price sensitive clients

within the enterprise VSAT, trunking and backhaul markets.

Source: NSR

Bottom Line

NSR does not deny that in the

short- to mid-term, there will be some significant competition

between satellite operators and service providers trying to sell

both classic FSS capacity as well as newer HTS and MEO-HTS

capacity to end user clients. These

competitive pressures will no doubt

lead to the perception that classic FSS capacity, at least that

used to serve various broadband satellite services, is under

pressure.

Nonetheless, NSR continues to see

real advantages to classic FSS capacity versus HTS or MEO-HTS

for certain client sets that transcend the pure price per bit

equation. FSS capacity

offers advantages of

larger coverage areas, typically better service quality, the

ability to fully manage the network from end-to-end, and the

flexibility to place hubs and gateways in any convenient

geographical location. It is the clients who value these aspects

of FSS capacity that will generate NSR’s forecasted growth in

FSS transponders for broadband satellite services.

However, other

clients will value higher the lower cost per bit of HTS and

MEO-HTS capacity. And,

in fact, NSR firmly maintains that the existing markets that

were already under pressure from terrestrial services now stand

a real chance of growing simply because classic FSS capacity is

not truly price competitive for these markets. In other words,

the industry was already losing the battle for these clients

regardless of the price pressure the classic FSS capacity was

under. On a net-net basis, NSR maintains the view that

HTS and MEO-HTS capacity will not

replace use of C/Ku/Ka-band transponders, but will instead

compliment and greatly expand the broadband satellite markets

for the industry to operate in.

This is where the industry needs to focus on in order to

succeed.