Even’s or Odd’s – Capacity Trends

in SNG/OU Markets

Jan

29th, 2014 by

Brad Grady, NSR

With the one-two punch of the Super Bowl and Winter Olympics

in Sochi just around the corner, 2014 continues to shape up to

be an upswing year for the contribution and occasional use (OU)

satellite TV markets. From the ongoing evolution of

UltraHD 4K content, the OU market is undergoing a steady

technological shift – from linear content capture to file-based

workflows, from traditional H.264 to H.265/HVEC, from C-band to

FSS Ka-band and GEO-HTS, and from primarily satellite-based to

increasingly a hybrid satellite-terrestrial transmission model.

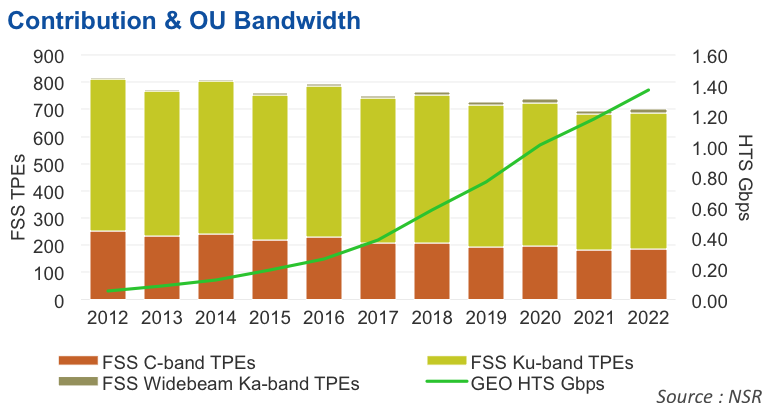

As the market for OU services continues to evolve, all events

from high-value content such as the Super Bowl or Olympics to

the reporter on the street continue to put pressure on the

steady even year-odd year trend steadily exhibited within the

Contribution and OU/SNG markets.

As NSR explores in its Contribution and Occasional Use TV

Markets report, major media events typically fall on even years

– World Cup, Olympics, and National Elections. It is the

trend that OU/SNG markets has always exhibited an even year peak

followed by an odd year valley. However, as the deployment

of fiber networks to major sporting venues continued to steadily

increase, with new stadiums going so far as running fiber

directly to the camera locations themselves to support the

latest 4K video streams, an ongoing evolution is occurring

throughout the market. Not only is the evolution a steady

decline in the need for satellite-based capacity for OU/SNG, but

the even-odd year trend is steadily diminishing. With more

fiber deployed to more large events, and file-based workflows

becoming the status-quo for live event productions, the ‘peaks’

from these events continue to decrease relative to the more

steady-state odd year trends.

Yet, simply attributing the decline in SNG/OU even-year peaks

to terrestrial solutions is not the entire story – as new

compression and satellite frequencies further contribute to the

overall utilization of satellite capacity for OU and SNG

services. The smaller form factors, easier ground

infrastructure, and IP-based network designs of FSS Ka-band

Widebeam or GEO-HTS remain significant drivers away from FSS

C-band or FSS Ku-bands for the lower to medium value content

productions. And, with fiber eating away at the high-end

production events, satellite continues to feel the pressure from

all sides. All-in-all, the result is a steady smoothing

out of satellite bandwidth demand, OU hourly demand, and the

number of contribution feeds.

Not all is lost for SNG/OU markets though. The rise of

OTT services, ‘second-screen’ media consumption, and the

insatiable demand for video-based media by consumers continues

to drive the demand for video from smaller and smaller events –

a silver lining for satellite services. Cable, DTH, and

online video distributors continue to scramble for ‘exclusive’

access to sporting and special events across the world – into

venues without widespread access to terrestrial networks – while

still requiring high resolution, high-quality production.

Bottom Line

This will be the next wave for SNG/OU

growth – smaller, smarter terminals with IP-centric file-based

workflows able to leverage a diverse set of satellite

transmission technologies. There will always be a market

for the larger FSS C-band SNG trucks, but the sweet spot for

both uplinkers and satellite operators will be producing the

same quality of content from smaller and smaller equipment

footprints – using a combination of FSS widebeam Ka-band,

GEO-HTS… and terrestrial.