Long Live C-band for Maritime!

Jan 20th, 2014

by Brad Grady, NSR

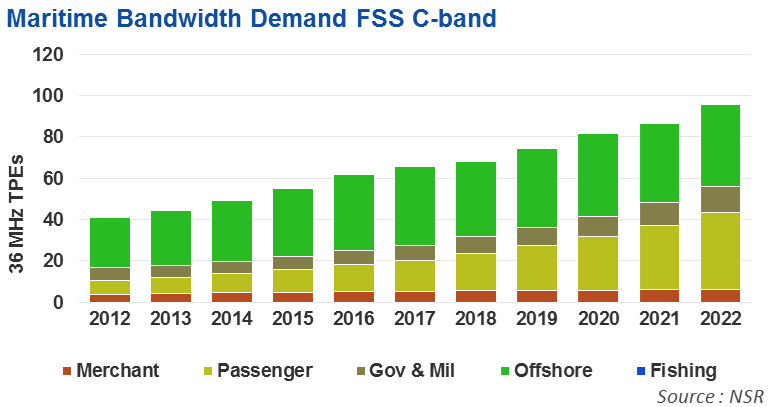

With many new HTS systems launching within the next 12 – 24

months, it is easy for classical FSS C-band capacity to get lost

in the mix. Yet, as NSR project’s in its Maritime

Satellite Markets report,

FSS C-band is not going anywhere –

adding another 55 TPEs of capacity over the next ten years.

Maritime service providers continue

to expand their FSS C-band capacity, as more end-users continue

to increase their bandwidth demands. Even KVH recently

announced a doubling of the capacity for two of the three global

C-band beams of its mini-VSAT Broadband network. Given

C-band’s near ubiquitous coverage for maritime markets (minus

the polar regions), high tolerance for rain-fade, and almost

8,000 In-service units by 2022,

FSS C-band still has a lot of momentum

within the marketplace.

But the real question remains: could there be an end in-sight

for FSS C-band for maritime markets?

In short, it is unlikely within even the next 15 years.

Even as GEO-HTS C-band based systems come online, their limited

coverage outside of major areas of maritime concentration (such

as Atlantic shipping routes or centers of Oil & Gas

concentration) continues to bolster support for the traditional

FSS C-band networks. Although merchant maritime traffic

will follow highly predictable routes between the major

land-masses, other maritime markets continue to roam the oceans

– from cruise ship routes opening up within the Pacific, new

areas of O&G activity, to ongoing military activities throughout

the high seas. These are all heavy users of FSS C-band

capacity and even with

the introduction of GEO-HTS and MEO-HTS, they will continue to

rely on FSS C-band.

Even merchant shipping – the largest market for maritime

satellite-based connectivity – will continue to lean on FSS

C-band capacity to enable highly robust network availability at

higher throughputs and better price-points than MSS-based

offerings can strictly provide. And,

robust network design continues to be

the significant factor in FSS C-band’s appeal.

However, some steady

migration of FSS C-band from primary to co-primary or secondary

roles will impact the per-unit revenue growth prospects

for service providers going forward. As more traffic

shifts towards FSS Ku-band, GEO-HTS or MEO-HTS solutions,

ARPU will likewise decline.

Instead, revenues will be driven by new vessels coming online

with hybrid systems installed where FSS C-band will remain a

critical component for service providers to enable high network

availability regardless of vessel location.

Taking the lead,

offshore maritime markets and passenger vessels will be the

largest consumers of FSS C-band capacity

due in part for their need for high availability (both in

frequency and in coverage), and larger bandwidth demands

compared to other maritime markets such as fishing or merchant

shipping. With frequent travels outside of major maritime

shipping routes, including trans-oceanic transit of vessels

between regional hot-spots, FSS C-band will remain a critical

component of their connectivity solutions. In short,

hybrid solutions with a

combination of FSS C-band and GEO-HTS will be a leading network

design going forward

within the offshore and passenger vessel market.

Not to be forgotten, FSS Ku-band will remain a critical piece

of the connectivity puzzle for maritime end-users, with demand

spread almost equally across the maritime market. But, for

the higher-end verticals, and higher-end maritime customers, FSS

C-band prospects still remain strong.

Bottom Line

With many other satellite markets

shifting away from FSS C-band, the maritime market remains a

strong market with ongoing bandwidth growth prospects.

Driven by the higher-end segments of the market – larger

passenger vessels, offshore end-users –

FSS C-band will remain a key

ingredient for maritime service providers looking to capture

high-end customers… alongside investments into GEO-HTS

architectures.