DigitalGlobe/AstriumGEO

– Niche vs. Mass Market

Nov 26th, 2013

by Stéphane

Gounari, NSR

DigitalGlobe held an

Investor Day on November 20 where it described its

strategy focused on key customers & partners. A week

before, AstriumGEO conducted a Webinar presenting

its Cloud solution; a product focused on numerous EO

end-users. Their strategies, while increasingly

different, look like a classic

Niche vs. Mass Market

opposition.

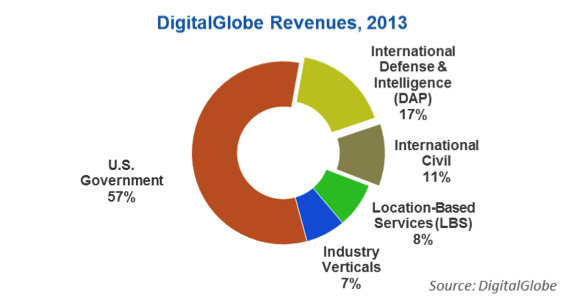

DigitalGlobe’s

customer base is very concentrated;

a few customers represent a large share of the

revenues. While the company aims to develop its

revenues from commercial companies (LBS and others),

it does not

plan any

radical strategy changes.

At the

same time, the company wants to increase revenue

from Processing and Information Services and to do

so, DigitalGlobe wants to leverage its imaging,

archive and processing capabilities through in-house

analytical solutions and through a network of

partners (as ESRI); thus through

internal capabilities and

key, selected partners.

This strategy is possible thanks to its imaging

capabilities (spatial resolution and spectrum),

which open the way to unique analytical solutions,

thus to

niche markets.

By focusing on key customers in niche markets and

using key partners, DigitalGlobe’s goal is to

maximize revenues while minimizing the cost of sales

through maximum efficiency. This should lead to

high-margin

revenues.

In 2012, less than 50%

of AstriumGEO’s revenues originated from Defense &

Intelligence customers; around 30% was from

commercial customers, and while Europe is the main

regional market, Asia is not far behind.

AstriumGEO’s

customer base is less concentrated than DigitalGlobe,

and

AstriumGEO’s

Cloud solution is in line with this strategy. It

allows users to directly task, order and process

imagery, but also to integrate it with other types

of data. As such, it

provides a

single-point-of-access to independent Information

Services providers

and end-users. The solution does not require

specific bilateral agreements, is open to every

player and is tailored toward SMEs.

This strategy is possible thanks to a very large

choice of imagery and a larger size than most of its

competitors. AstriumGEO’s strategy should attract

numerous

SMEs

looking for imagery that is easy to access and use,

including most likely start-ups developing

cutting-edge analytical solutions. AstriumGEO will

be able to

tap into the vast network

of Information Services

companies,

extending the range of applications for its imagery.

This should ensure a

large, diversified and

constantly evolving usage of AstriumGEO imagery.

Bottom Line

Both business models

are in line

with their current customer mix and imaging

capabilities;

however, both have specific challenges.

DigitalGlobe will continue to rely on large

customers, with the

risk associated.

Besides its internal analytical capabilities, it

will leverage those of a few selected partners; to a

certain extent this

will limit the applications

and potentially the

innovation rate.

Moreover niche markets are

limited in size,

which will force DigitalGlobe to either

create new

applications or address the mass market.

As its distribution system is not optimized for the

mass market, DigitalGlobe’s imagery will be less

easy to use, thus

losing value when compared

to EO satellite operators with a mass market focus.

As for AstriumGEO, a

mass market

focus implies lower margins.

To compensate, AstriumGEO will have to

capture a large(r)

share of the market.

At the same time, other EO satellite operators with

similar imaging capabilities will most likely choose

the same cloud-strategy; therefore, AstriumGEO will

have to constantly improve its own Cloud solution or

lose the value it brings to its own imagery and be

forced to more intensely compete on price.