Reality Check on MPEG-2

Nov 13th, 2013 by

Patrick French, NST

UltraHD TV and HECV

encoding have been getting a lot of attention in recent

months as the satellite industry tries to understand

how, and how fast, we will get to this exciting new

future of carrying big fat channels over satellite

transponder capacity. It is indeed a subject worthy of

attention, nevertheless it is NSR’s view that the

industry also

needs a reality check on where we stand today in terms

of encoding standards

for carriage of the current crop of SD and HD, as well

as 3D, channels.

For over a decade, NSR has tabulated end-of-year data

for the number of satellite channels carried on each

operational satellite and transponder as part of its

regular market research process. Starting in 2012, NSR

also began to collect information on the encoding

standard employed for each channel, segmenting its SD,

HD and 3D channel counts between channels encoded in

MPEG-2 and similar generation formats (e.g. Conax,

Nagravision) from MPEG-4 encoding. The results of this

effort shed

some light on what is truly begin done in the broadcast

markets today.

Source

NSR

Source

NSR

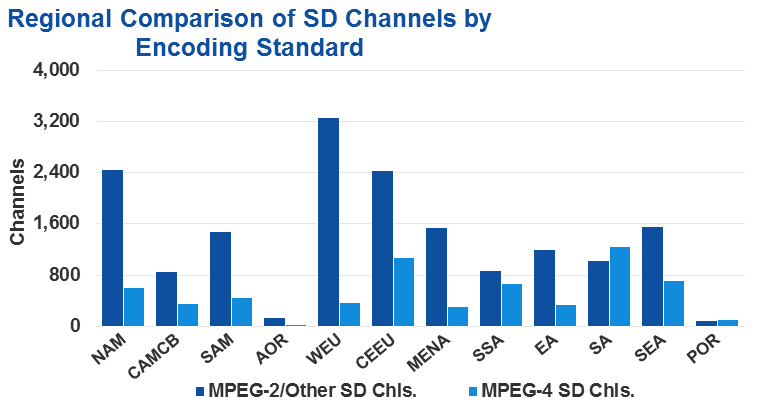

Of the 23,182 SD channels NSR attributed to the

global satellite market as of the end of 2012,

fully 73% were still

broadcast in MPEG-2 or another similar format.

This includes all channels carried for C/Ku-band

distribution, FTA, DTT, DTH and other related broadcast

services. Interestingly, one can also see that on a

regional basis, the markets one tends to

think as the “most developed”

such as North America or Western Europe, actually have

the greatest

number of SD channels still being broadcast in the older

MPEG-2 and related formats.

Fully 80% of SD channels in North America and a

staggering 90% in Western Europe used the older encoding

technology compared to regions like Sub-Saharan Africa

or South Asia where about half of the current crop of SD

channels were being carried in MPEG-4.

Source

NSR

Source

NSR

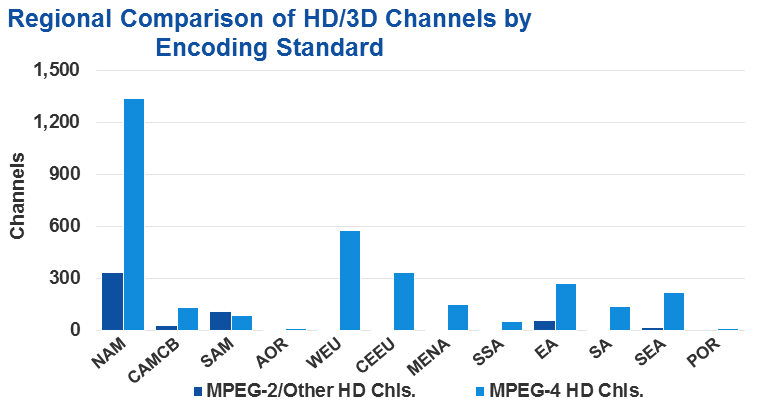

However, the story is completely inversed when it

comes to HD and 3D channels. Of the 3,836 HD/3D channels

carried globally, no less than 86% were broadcast using

MPEG-4 encoding at the end of 2012. Nearly

all regions were well

over 80%, if not effectively 100%, MPEG-4 for HD/3D

content. Of

course, this is not too surprising as it is the more

efficient MPEG-4 encoding standard that makes HD/3D

content economically viable for the video markets.

Overall, the results of this assessment indicate

something most in the satellite market “instinctively”

understand. New

technology standards generally do not kill markets, but

drive new market opportunities.

The arrival of MPEG-2 digital broadcast led to a quantum

leap in the diversity of channels by making satellite

broadcasting so much more cost effective. The same is

true for HD/3D channel growth being directly linked to

the adoption of MPEG-4, and the industry will almost

certainly see a repeat of the same with

UltraHD’s ultimate success

being directly linked to adoption rates of the HEVC

encoding standard.

Bottom Line

Yet, NSR’s detailed

analysis of the breakout in carriage of SD, HD and 3D

channels between the different standards still raises a

number of issues that lead to challenges/opportunities

that media markets will face in the coming years. These

include:

- Despite

the widespread availability of MPEG-4,

why are so many SD

channels still broadcast in MPEG-2?

Granted, much of this is related to the dynamics of

individual regional markets as well as the sunk cost

in installed bases of MPEG-2 consumer set-top boxes

and IRDs in teleports and headends. But this begs

the question,

is there a market opportunity to force a faster

transition to MPEG-4 for SD content?

Or is it better to

jump straight to HEVC?

And depending on which route the SD channel encoding

migration follows,

how much of the freed up transponder capacity can be

used to support carriage of even more content

without launching new transponder supply?

-

Similarly,

is there an opportunity to move more HD content to

MPEG-4 in a few specific regional markets, notably

North America, East Asia, and South America?

And most especially for South America,

what impact would an HD

migration to MPEG-4 have on the currently tight

capacity situations at the main cable distribution

hot spots?

-

-

Finally, most industry

experts agree that UltraHD is still quite a few

years into the future and the benefits of UltraHD,

especially in terms of capacity leasing, probably

won’t have a substantial impact on operator bottom

lines until the end of the decade. As such, is there

not a much

more significant market

opportunity at least in the short- to mid-term in

teasing out the transition from MPEG-2 to MPEG-4?

(Especially for the huge bulk of SD channels that

still account for the biggest part of capacity

leasing in media markets today.)

In short, yes, UltraHD is great for the satellite

market, and HEVC is certainly a key to success here.

However, instead of focusing so much market energy on

opportunities that are the better part of a decade into

the future, why not put some of that effort into

opportunities already available today?