|

Differentiation

Engine Restarting for EO Data

Oct 29th, 2013

by Stéphane

Gounari, NSR

Historically, differentiation in the EO data

market was achieved through spatial resolution

and spectrum. Since the data commercially

available reached the limit of shutter control

regulations (WorldView-1 in 2007), the race for

data product differentiation slowed down.

Companies providing 50cm resolution imagery

cashed-in, some of them developing their

spectrum capabilities, while other companies

worked at catching-up.

Now that more companies propose 50cm imagery,

incumbent players have to find new means of

differentiation to maintain their niche and the

revenues that come with it.

The recent calls to

lower the shutter control regulation limit are

now in line with incumbent future capabilities:

- DigitalGlobe (USA) claimed it would

immediately be able to address the new data

market thanks to satellites currently or

soon-to-be in-orbit with a resolution close

to 30cm (and unique spectrum).

- Thales Alenia Space (France) claimed it

would immediately be able to provide Optical

payloads with a resolution lower than 50cm.

It is likely only a matter of months before

shutter control regulations are lifted in the

main markets, especially as other imaging means,

such as Aerial and UAVs, are not constrained by

such regulations and provide imagery with a

resolution below 10cm, considerably

weakening the

legitimacy of such shutter control regulations

for satellites.

One could expect

Defense & Intelligence (D&I) organizations to be

the main clients of <50cm imagery. However the

largest

D&I organizations already have access to

commercial <50cm imagery;

therefore, they will not be at the origin of a

huge boost in orders. However, other vertical

markets such as Energy & Natural Resources (Oil

& Gas, Mining), Services and Industrial will

welcome this imagery. This will have

large

consequences on Processing and Information

Product markets

for two reasons:

D&I (and Public

Authorities) have a strong trend to

internalize such processes,

limiting the growth of the market, while

commercial verticals tend not to.

Historically, as D&I were the first and main

clients of the highest resolution imagery,

growth of data did not translate into huge

growth of Processing and Information

Products.

Second, the

value of

Processing and Information Products done

over imagery is correlated to the resolution;

the higher the resolution, the higher the

Processing and Information Products over

Data.

As large parts of D&I needs of <50cm imagery

are already satisfied, the ratio between the

growth of data markets and the growth of

Processing and Information Products will differ

greatly. While Processing market growth will be

restrained by other factors (such as

automation), Information Products will not.

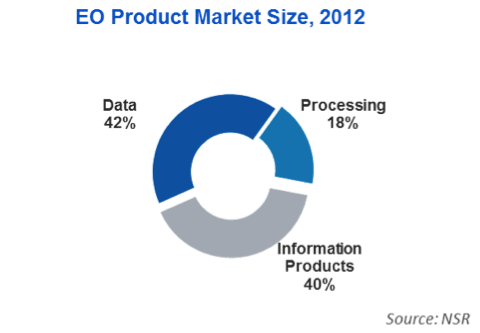

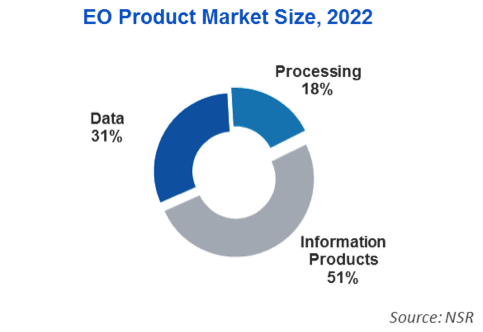

Information Products will hugely benefit from

any weakening of shutter control regulations,

over time representing an

increasingly higher

share of the Satellite EO Industry.

Bottom Line

In a somewhat

typical situation,

major players are

competing on historical differentiation aspects,

while

new players work on proposing radically

innovative data products

(data products with very specific

characteristics):

- Video

Data Products:

Several companies announced such projects;

the most advanced is SkyBox Imaging (first

launches in 2013) with video data products

featuring 30 frames by second.

-

Meteorology Data Products:

Several companies

announced such projects; the most advanced

are GeoMetWatch (Hyperspectral Atmospheric

Sounders in GEO) and GeoOptics (atmospheric

sensing satellites).

The satellite EO

industry is therefore at the dawn of new period

of strong growth, driven by old factors pushed

further (spatial resolution and spectrum) and

brand new products.

|