Manufacturing & Launch Services Diversification: Limited but Necessary

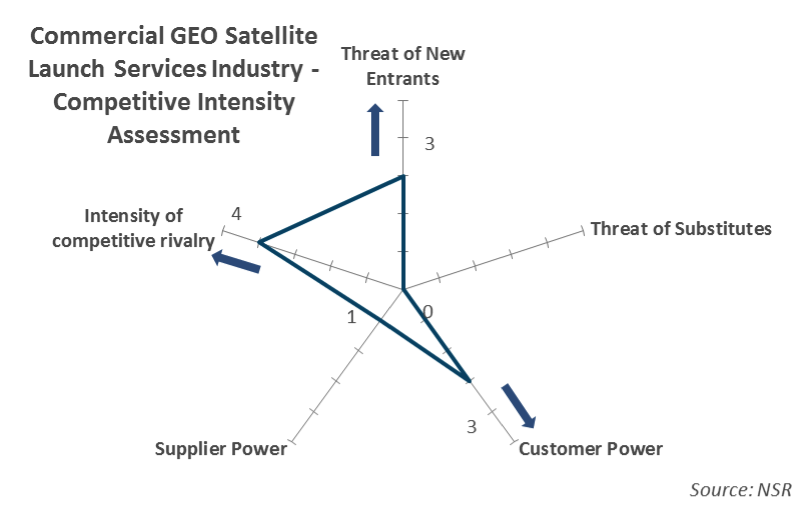

Both the commercial satellite manufacturing and launch services industries now face a low(er) demand period with increasing supply. Albeit difficult, differentiation is more necessary than ever. In both industries, the competitive intensity is already high and should continue to increase mainly due to the following reasons:

- Low(er) demand

- Significant barriers to exit

- New entrants

In such a context for a player to maintain its revenue, it will require an increase of its market share via two generic strategies: cost leadership and/or differentiation. Cost leadership is always difficult to maintain; in commercial space this seems even more challenging given the lack of volume in the open market, the captive markets that most players enjoy and governments’ backing (allowing companies to decrease their prices). Differentiation seems the only way to go, but options are limited.

In the launch services industry, competition mainly rests with reliability and launch cost. The extent to which reliability can evolve is limited as it has a ceiling (100%) and a minimum value given satellite operators won’t contract a launch service whose reliability is too low. And in any case, reliability’s strength as a differentiator is limited as insurance transfers it into the launch cost. Differentiation must therefore be based on other aspects such as launch capabilities, fairing sizes and additional services.

Making things worse, as satellite operators tend to avoid procuring satellites tying them to one launch services provider, it limits, but does not cancel, the impact of differentiation based on launch capabilities and fairing size.

Arianespace recently announced they were considering the development of a new, longer (19m) payload fairing for Ariane-5, potentially ready by 2015. A fairing of similar length is being developed for Ariane-5ME, potentially ready by 2017. Therefore, this new fairing would be used for a few years only. The main rational announced for this improvement is to better address electric/hybrid satellites, which are expected to be bigger than chemical satellites. But it may also be a reaction to Proton’s new fairing, to be ready in 2016, featuring a diameter similar to Ariane-5’s.

Arianespace’s urge to develop a longer fairing may therefore be based on a differentiation strategy, to stay one step ahead of its main competitor.

The satellite manufacturing industry features an increasing differentiation potential, mainly platform power, mass and main propulsion capabilities. There are two methods to use power and mass to differentiate: the first one is to focus on a specific segment of the market, without pushing the boundaries but proposing a very efficient product (Orbital Sciences Corporation strategy, albeit changing). The other method is to push the boundaries, to propose platforms with unique payload power/mass. This is SSL’s “high-power” strategy (now proposing around 20kW of payload power). This is however limited by the launch services supply (mass capabilities).

Boeing’s introduction of an all-electric platform boosted propulsion as a differentiating factor by proposing a platform with a much better mass/power ratio (but with downsides). If all-electric platforms may not be the way to go, Boeing’s move clearly impacted the differentiation aspects.

Bottom Line

Given the context, competitive is high and will continue to increase. Satellite manufacturers and launch services providers will have to differentiate their products or prepare for the consequences of being stuck in the middle (competition based on price). They will have to be innovative and regularly find new ways to differentiate, ultimately for satellite operators’ pleasure.