Don’t Forget the Kbps in the Energy Markets

by Brad

Grady, NSR

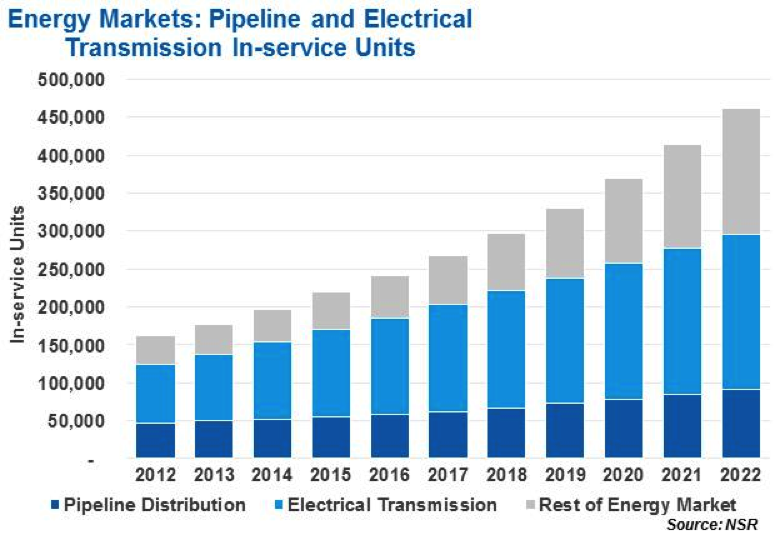

Amidst the bandwidth revolution, it is easy to forget there is an entire class of In-service units within the high-end energy satellite communications market that continue to operate in the murky waters of ‘nearly’ broadband. Serving critical SCADA requirements – Oil and Gas Pipelines, Electrical Utility Transmission and Distribution networks, or in remote well-site deployments- these units remain a workhorse of the Energy market for satellite communications. As NSR mentions in its Energy Markets via Satellite, 3rd Edition report, oil and gas pipelines and electrical transmission, distribution, and renewable energy installations are solid growth opportunities for both VSAT and MSS deployments – but do not have the multi-megabyte throughput requirements found elsewhere in the energy markets. With over 90,000 In-service units by 2022 in the pipeline sector, and 200,000 In-service units for electrical transmission networks projected by 2022, the vast majority of energy market satellite deployments will operate within these ‘nearly’ broadband environments. Even with monthly ARPU well below $500, the shear number of units will be a sizeable revenue stream for both service and equipment providers.

Driving growth is the need for data; to maximize productivity, and to enable physical security requirements. “Big Data” is not just multi-terabyte 4D seismic-GIS datasets, but thousands of substations in an electrical transmission network sending a few bytes of data every few minutes, or hundreds of pipeline compressor stations displaying near-real time flow rates or pressure readings. Across the energy industry this ‘small data’ problem is rapidly being solved with ‘big data’ solutions, enabling companies to look deeper into their operations to reduce cost and optimize productivity. Electrical grid reliability initiatives, enabling utilities to pin-point troublesome power lines or transmission substations, involve the frequent polling of these sites – oftentimes in the thousands across a utilities territory – generate a big data problem. Smarter grids, which in their essence is a feed-back loop to grid operators from the remote end-points of the network, are becoming more common-place with aging infrastructure, severe weather events, and energy efficiency programs. Although a vast majority of these deployments will be terrestrial in nature, satellite communications will still play a significant role in disaster-prone areas to enable resilient infrastructure or in developing countries where terrestrial infrastructure is unreliable. Increased remote monitoring and control also maximize remote workforce productivity, critical in an industry that continues to face workforce shortages. For remote pipelines or well-site applications, remote logging of pressure or flow-rates alone can have significant cost savings in terms of manpower. Newer generations of satellite units can go a step further, and directly control remote equipment to optimize operating conditions – increasing total revenues for end-users. In both cases, this optimization is driven by ‘big data’ in ‘small bytes.’ Yet, even in this market signs continue to point towards bigger bytes of data – remote video monitoring being a leading driver of demand. With the increase in Critical Infrastructure Protection regulations, along with more remote monitoring of equipment resulting in fewer visits by service personnel, remote video monitoring will be the driver of bandwidth growth going forward. Intrusion detection for substations or well-pumping stations, or checking for environmental hazards like well fluid leaks through high-quality remote video links continue to nudge the throughput requirements higher in even this segment. However, by comparison to offshore exploration and production or mining locations, these will still be a drop in the bandwidth bucket on a site-by-site basis. Bottom Line Enabling remote monitoring and control, these units are punching far above their provisioning by reducing remote site visits, enabling unmanned monitoring and control, and meeting critical infrastructure protection requirements. Generating a ‘big data’ problem for energy companies through lots of little bytes, the murky waters of ‘nearly’ broadband SATCOM deployments will be a key component of their optimization strategies into the future. For satellite service providers and equipment manufacturers, these VSAT and MSS units will be a core building-block of the energy satellite communications marketplace. |