Satellites and In-Flight Connectivity: A Match Made in Heaven?

In-flight connectivity has been a buzzword for the satellite industry for the past five years with many hiccups in the relationship until recent success finally hit both commercial and government markets. With more capacity and coverage as well as content aimed at improving the passenger experience, is the link between satellite and in-flight connectivity a match made in heaven?

Contracts and strategic moves made by high-profile players demonstrate the need to offer more and higher capacity at cruising-altitude on a wider footprint via satellite.

Just prior to announcing a second high-throughput satellite (HTS) that will extend its networks to serve trans-Atlantic air routes, ViaSat consolidated its leading position in the lucrative VIP aircraft niche market through an agreement with L-3 Platform Integration. Together, they will custom-fit Heads of State and other high-flyer airline-sized planes with the latest Ku-band connectivity on a global scale.

A few months ago, GoGo, the leading IFEC provider of in-flight connectivity via air-to-ground (ATG) services in North America, signed capacity deals with SES and Intelsat to extend its network for its commercial airline clients. The FCC this month gave its blessing to operate Ku-band terminal for GoGo’s expected deployment on 400 aircraft flying across the ocean.

Why is it important for players such as GoGo and ViaSat to get higher Ku-band satellite capacity (in this case via Ku-band satellites) when the former is doing very well and growing its ATG network and ViaSat is investing heavily in next-generation HTS Ka-band satellites? The answer lies somewhere between “They’ve been together for so long” and “It’s a match-made in heaven”.

It has been a rough road and one that actually saw failure while other connectivity services bloomed. Indeed, from zero in-service units in 2007 to over 2,000 aircraft flying on its network in 2012, the success of air-to-ground connectivity cannot be denied, and the ATG value-proposition set the wheels in motion for a change in travellers’ connectivity expectations. GoGo is now finding its ATG has limits after only five years of operations, and one way out is to leave the ground and leap on available, higher bandwidth satellite with coverage outside the U.S. Through its business jet customers first, Gogo now wants to expand its commercial customer base on SES and Intelsat’s networks as ATG markets will eventually stabilize and show lower growth due to technical and coverage constraints.

For ViaSat, its ties with government and business jet customers have made it one of the leaders in the Ku-band satellite market. Is there a good reason to then head towards Ka-band HTS capacity with oceanic coverage, which could trump its current Yonder Ku-band service?

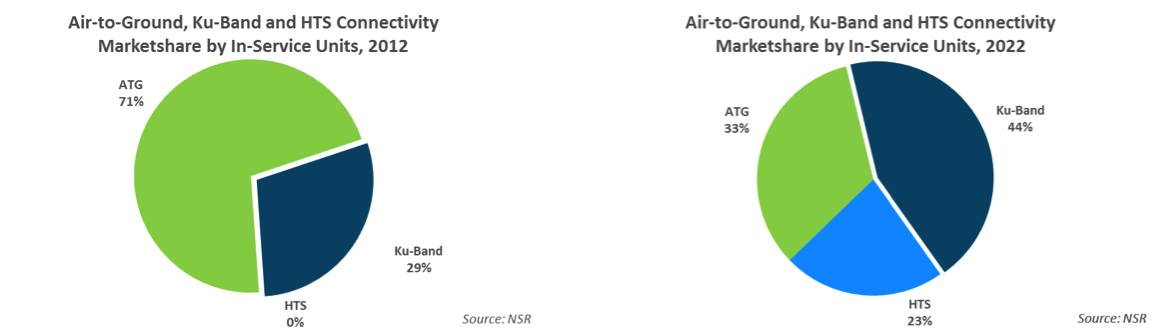

In its recently released Aeronautical Satcom Markets report, NSR indicated that in the next ten years, revenues from aeronautical connectivity will see a transition from regional commercial airlines to global airlines. It also indicated a shift in bandwidth services from ATG to Ku-band and eventually to HTS as airlines demand more bandwidth and a larger integrated footprint.

Thus, NSR believes the move to secure customers by offering them a more global footprint now with higher bandwidth ensures that they will grow or at least keep their share of the promising in-flight connectivity market as bandwidth demand grows and the market evolves to HTS. One should not be surprised then that both ViaSat and GoGo have HTS in their plans, which will likely attract many new but also (and mostly) current customers to higher-capacity global connectivity.

Bottom Line

The linkage between aircraft and satellites has developed over the years to become one that extends not only the range but also the speed of deployment of the in-flight connectivity market. As customers on both commercial airlines and government planes demand more capacity, in-flight connectivity and satellite is probably not the perfect match, but they are likely to remain strongly linked for the years ahead.