Grinding Out Broadband Access Subscribers

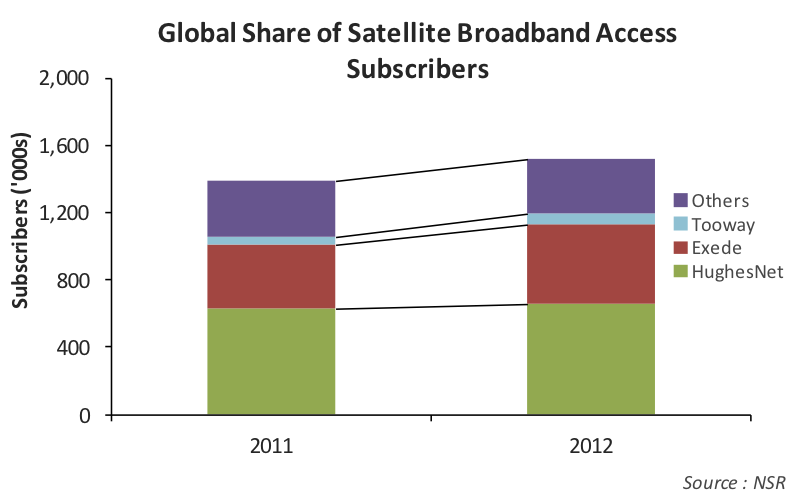

The end of year 2012 results are in, and it turns out that despite some excessive industry expectations at times, the satellite broadband access market is beginning to see the payoff of moving to the next generation of very high capacity HTS. As of the end of last year, all three of the best known HTS-powered broadband access services … Tooway, Exede, and HughesNet … saw sustained subscriber growth. NSR expects that 2013 will be a productive year as well as the main players turn their focus from planning for the future to the real task of grinding out the new subscribers and competing in the highly competitive broadband market.

EchoStar Corporation reported that the subscriber base for its Hughes Communications subsidiary reached 659,000 as of 31 December 2012, which is up from 626,000 from a year earlier. More important, the HughesNet subscriber base had actually shrunk down to 616,000 through to 30 September 2012 as Hughes was waiting for the launch of its HughesNet Gen4 service based on the new EchoStar-XVII (Jupiter) satellite. This implies a real net subscriber gain of about 43,000 in the last quarter of 2012 and likely a gross subscriber growth rate of several times this number.

Turning to ViaSat, the company announced some 77,500 installations accounting for 62,000 gross subscriber additions in its fiscal year 2013 third quarter (30 December 2012) reporting period. Total Exede subscribers, including heritage subscribers to the former WildBlue service, reached 467,000 with just under half of these carried on the ViaSat-1 satellite. By NSR’s estimate, this represents a net gain of over 80,000 subscribers since ViaSat-1 went operational in January 2012. ViaSat also got a dose of welcome news in February 2013 when the FCC announced that the Exede product was first ever satellite broadband access service to be included in its annual benchmarking study of broadband speeds and, even better, Exede claimed the top spot of all broadband services assessed … including terrestrial services … for exceeding advertised speeds.

Finally, Eutelsat’s first half 2012-2013 report stated that its Tooway consumer broadband services on KA-SAT reached 72,000 active subscribers as of 31 December 2012, up from 52,450 on 30 June 2012. After a slow start following the formal launch of Tooway services on KA-SAT in May 2011, Eutelsat’s efforts to rework the management team behind the Tooway product appears to have begun to pay off. This was illustrated by the new service plans announced in January 2013 reaching download speeds of 20 Mbps and 6 Mbps for upload. Only a few years ago, many satellite broadband services were still being measured in Kbps of speed, and this represents a remarkable increase in performance. Eutelsat is also signing significant deals with some of its strongest distributors, such as the February 2013 partnership with skyDSL Global GmbH who agreed to a five-year multiple spotbeam capacity contract on KA-SAT.

Bottom Line

In the lead up to the launch of satellites like ViaSat-1, EchoStar-XVII and even KA-SAT, there is no mistaking the fact that the industry set very high expectations about the importance that this new class of satellites would mean for the future of satellite broadband access services. The clear understanding was that without these satellites, there would be no future for satellite broadband access market of any significant size.

While satellite broadband access services are not out of the woods yet and still face real challenges from the dominant terrestrial services in the highly competitive global broadband market, the first signs are beginning to show that this new class of satellite broadband services is making its mark. Service providers like Hughes, ViaSat, Eutelsat and others still have a lot of work to do to chip away at the old impressions of poor satellite broadband service quality and replace them with the new. This will take some time and effort, but the latest subscriber growth numbers as well as independent assessment like that from the FCC are highly encouraging for the industry and merit due appreciation from all.

Information for this article was extracted from NSR's report Broadband Satellite Markets, 11th Edition