Recently, U.S. Direct-to-Home platform Dish Network released plans to offer high-speed, satellite-based broadband to its subscribers. Labeled “DishNet”, the service utilizes capacity from ViaSat and Hughes to deliver up to 10 Mbps to subscribers in either 10 GB or 20 GB data-limited flavors. With a significant discount for bundling Dish DTH services with Internet plans, the service aims to provide Internet connectivity to the largely rural subscriber base of Dish Network. However, what really sets this deal apart from other similar offerings is the close relationship between Hughes and Dish Network through EchoStar. In addition, in the highly mature market of the United States, DTH platforms will need to diversify revenue streams in order to continue growth.

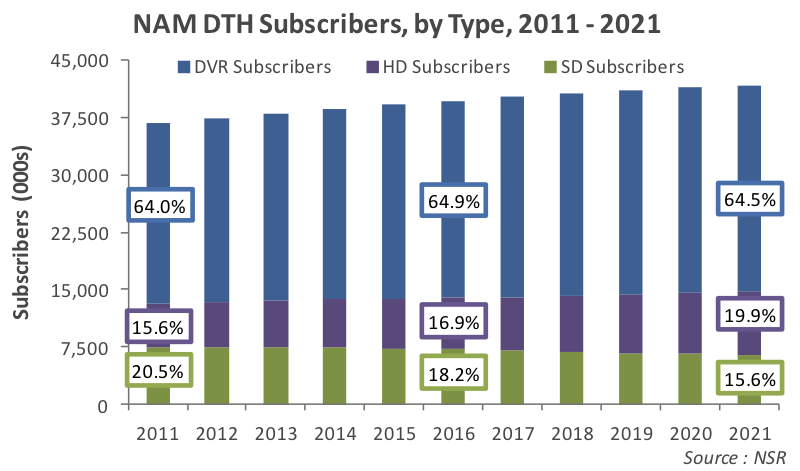

As NSR explains in its Global Direct-to-Home Markets, 5th Edition, the North American DTH market is the most mature of all DTH markets, with subscriber growth of 1.3% expected from 2011 to 2021, and revenue growth of only 2.2% over the same period. With little growth coming directly from their core businesses, and a general shift away from traditional linear TV viewing in the U.S., both Dish and DirecTV need to look for other sources of revenue growth. Additionally, the recent acquisition of Blockbuster Video’s physical and Internet-based services provides yet another source of revenue for Dish. All told, DishNet represents a critical point in the economics of U.S. DTH platforms – an increasing trend towards reliance on services other than delivering multi-channel video over satellite.

Offering rural users broadband Internet provides a growth opportunity for Dish Network’s bottom line. Beyond the revenues from the offering itself, electronic programming guides, video-centric user interfaces, and advanced app-enabled STBs all demand higher Internet connectivity than current rural dial-up can provide. With a projected decline of nearly $800 Million in Standard-Definition subscriber revenue from 2011 – 2021, moving these rural subscribers to higher-end services will be a key enabler of future revenue growth within the market. Key to this upward movement of subscribers will be access to higher Internet speeds so they can take advantage of more sophisticated services.

Recent data suggests that the average Netflix subscriber streams anywhere from 40 – 100 minutes of content per day – a rate unsustainable through data-limited satellite Internet connectivity. Although rural subscribers are likely to stream significantly less than the average Netflix subscriber, looking forward even these rural subscribers could increase their usage of Internet-based media if the option was available. With an OTT offering of their own through Blockbuster, the 10 GB or 20 GB data-plans will continue to leave rural subscribers out of the Internet-streaming revolution – for now. Looking forward, it would not be hard to imagine some type of additional data given to those subscribers who select the Dish OTT offering.

The ‘game changer’ in this picture is the close relationship between Hughes and Dish Network through corporate parent EchoStar. Using the newer High-Throughput Satellite (HTS) offerings from Hughes, the service is likely to provide better margins than a strictly ViaSat branded offering. These better margins will continue to help the bottom line, as rural subscribers move up the value-chain from basic SD subscription packages to more advanced HD and DVR services.

Bottom Line

Although the technology, and basic service offerings are more ‘game same-er’, the close relationship between Dish and Hughes, combined with a significant bundling discount, swings the pendulum towards ‘game changer.’ Not to be left out, DirecTV is looking to bring a similar product to market in the summer of 2013. U.S. DTH platforms continue to diversify revenue streams, and in the process strengthen their core offerings of multi-channel video services. Bottom line, the synergies enabled through high-speed Internet access to rural subscribers through this bundled offering will be greater than the sum of its parts.