Argentina just announced that it cancelled an auction for the 25% of the country’s 3G spectrum still controlled by the government, and will go instead into business itself through ARSAT, the state-owned satellite company. The government cites competition as the reason for the move as well as its goal of helping rural populations access the web.

Using ARSAT as the satellite backhaul platform particularly in parts of Argentina where consumers and small businesses have little or no choice when accessing the web could certainly boost rural 3G adoption. However, a key question is whether the model is sustainable given ROI considerations in rural and underserved areas where 3G provisioning has remained a major challenge due to cost structures.

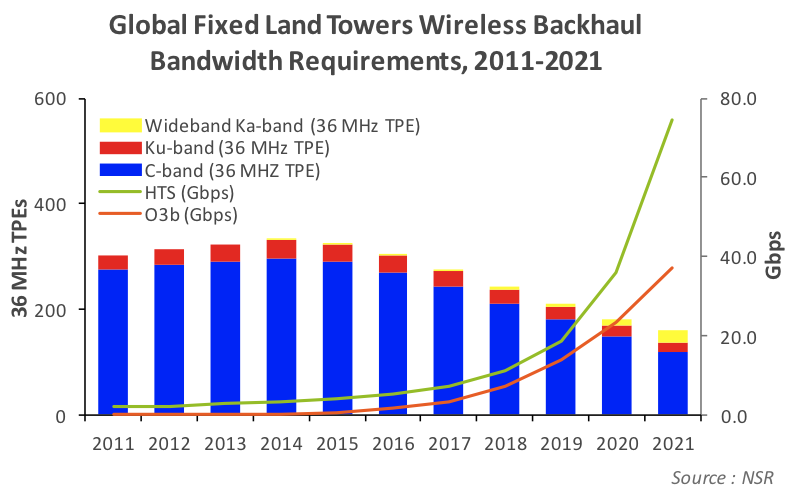

As a general trend in the global wireless backhaul via satellite market, a market shift is expected to take place. NSR expects usage of legacy C-band and Ku-band transponders will decline and be replaced over the long term by HTS and O3b due primarily to lower OPEX costs, leading to positive ROI and thus, deployment of wireless BTS sites in support of 3G or 4G services.

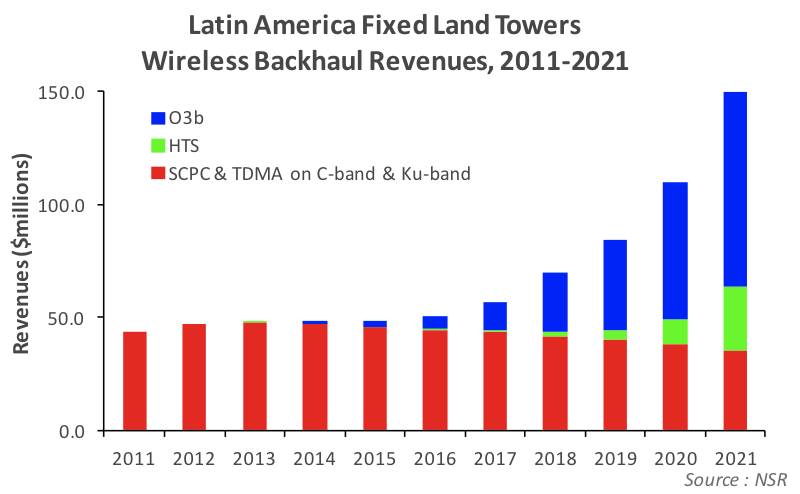

In NSR’s latest research study, Wireless Backhaul via Satellite, 6th Edition, the Latin American satellite backhaul market was indeed found to grow at high levels particularly in the 2018-2021 timeframe. The main reason for growth has to do once again with the entrance of HTS and O3b that drive down OPEX costs. For HTS, CAPEX due to lower equipment costs further enhances ROI prospects.

ARSAT is building three satellites based on legacy C-band and Ku-band transponders in part to provide 3G rural services where it is predicated that with the government’s help, small companies and cooperatives should find it much easier to become wireless and Internet providers. However, the OPEX equation based purely on commercial legacy C-band and Ku-band transponder prices may not support the ROI considerations to enable wireless and Internet providers to justify infrastructure investments.

In NSR’s view, the government’s plan to go into business itself via ARSAT can only be justified from a satellite backhaul perspective if the transponder costs are subsidized or ARSAT is used as an internal cost mechanism to support the rural backhaul 3G market in Argentina. The government has to contend with much lower ARPU levels that rural customers will pay for wireless and Internet service compared to their urban counterparts. From a purely backhaul perspective, rural ARPU at or below $5 per subscriber per month may not be enough to justify a BTS deployment and 3G service provision for a given site or community.

As such, the government’s plan in targeting rural areas may not be based purely on commercial business considerations. Although the goal is novel, it would appear that the rural program may become a government-backed venture where ROI considerations and profitability may not be attained using traditional C-band and Ku-band transponders.

Bottom Line

The government has two options to enable rural wireless broadband usage:

- First, the government via ARSAT becomes the wireless and Internet provider to support the program;

- Second, the government will have to sell C-band and Ku-band capacity at huge discounts to wireless service providers and wireless ISPs to usher in BTS and service deployments.

In both cases, some form of subsidy will be at play. A purely commercial 3G and 4G rural backhaul solution can be realistically achieved via an HTS or O3b platform. Using legacy C-band and Ku-band bandwidth can achieve 3G-like services or 2.5G services, but the service provider margins will likely be low, which will likewise become a market restraint.

In NSR’s view, provisioning true 3G and 4G services using legacy C-band and Ku-band for backhaul would require ARSAT to target urban customers aggressively and displace the market share of current incumbents in order to subsidize its rural 3G initiative.