The renegotiation of the SpaceX/Iridium launch services agreement (LSA), announced in early August, may signal cash-flow difficulties for SpaceX and could create challenges for the company in the short term. Fortunately, better days may only be a few months away.

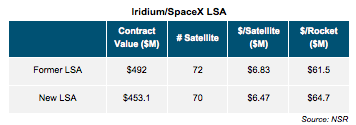

On August 2, Iridium announced a modification of its LSA with SpaceX. Initially calling for 72 satellites over 8 rockets (cost of $492 million), the LSA now calls for 70 satellites over 7 rockets (cost of $453.1 million). Cost savings appears to be the primary reason behind the lower number of rockets.

But several aspects of this deal are raising questions. For a reduction of 2 satellites, the new LSA’s price is reduced by $39 million, while a $/satellite calculation calls for a discount closer to $14 million. Moreover, the new payment plan is less attractive for Iridium in the short term.

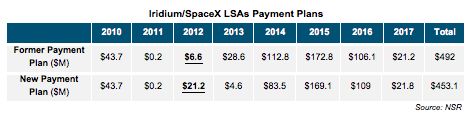

Under this new payment plan, Iridium will pay more in 2012 that it would have done with the former plan, while the contract’s total value is lower. Moreover, the first launch will happen in mid-2015, several months later than initially planned (hardware costs should be delayed as well).

With many projects, no commercial revenues, not being publicly traded, thus only counting on public money and private investments, SpaceX’s financial situation is regularly questioned. With that in mind, one interpretation would be to consider that Iridium’s discount is related to the new payment plan; that Iridium will finance SpaceX in 2012. If this modification, announced in the very middle of the summer, was to be interpreted that way, it could mean SpaceX is running-out of cash.

SpaceX’s first operational ISS-mission is scheduled for October 2012. If it is successful, SpaceX should receive the payments associated, and this cash-flow issue could prove to be nothing but a very understandable last-kilometer fatigue.

However, if this launch was to be delayed further (it was first scheduled on August 9, then on September 24) and for a long time or worse, if the launch was to be unsuccessful, a non-operational cash-strapped SpaceX would be weak, its resilience capacity minimal, and it would be forced to speed-up and take risks.

As the last NASA contract won by SpaceX (CCiCAP) includes a $20 million “financial and business review” (right after a $40 million “kick-off meeting”) scheduled for August 2012, its cash-flow situation should soon become clearer.

Bottom Line

Most of the contracts on SpaceX’s crowded manifest are for Non-GEO launches. If those had to be reassigned on short notice, the existing non-SpaceX supply would probably not be sufficient. This could drive non-GEO launch costs to new peaks for the unprepared.

But no-one could say ISC Kosmotras is fully taking advantage of this situation. Along with the modification of its LSA with SpaceX, Iridium announced it contracted ISC Kosmotras for one launch. Likely contracted under an agreement signed in June 2011 (6 launches, $184.3 million), the surprising $24 million launch cost figure implied by Iridium’s Management beats the already impressive $30.7 million figure reached by the 2011 agreement.