New Era of U.S. Military Procurement

May 1st, 2012 by Jose Del Rosario - NSR

Various studies within the U.S. Government indicate that past procurement processes by the U.S. Department of Defense have led to high costs, particularly for bandwidth. With the lingering uncertain fiscal environment and the lower defense budget passed by the U.S. Congress, the impetus for lowering costs in order to yield substantial savings is being undertaken.

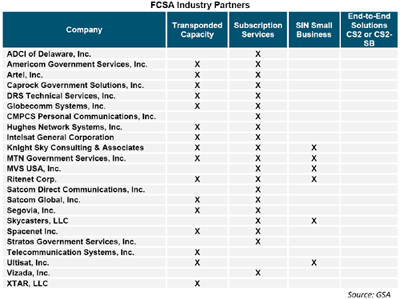

The legacy contract vehicles -- the Defense Satellite Transmission Services-Global (DSTS-G), SATCOM II, Inmarsat and Schedule 70 – have been consolidated into the Future Comsatcom Services Acquisition (FCSA) catchall vehicle. The thrust of the FCSA is aimed at leveraging economies of scale, streamlining the procurement process, promoting competition among vendors and, ultimately, obtaining lower prices for bandwidth.

The contracts for Transponded Capacity have been granted to 16 companies and to 20 vendors for Subscription Services at the end of 2010 and through 2011. Both contracts have a potential value of up to $5 billion. On 17 February 2012, the FCSA Custom Satellite Communications Solutions Small Business (CS2-SB) contracts were awarded to five companies for a five-year, $900 million indefinite delivery, indefinite quantity (IDIQ) contract. At the writing of this article, only the CS2 full and open contracts remain to be awarded valued at $2.6 billion, which is also on an IDIQ contract basis.

Spending Shift

In NSR’s view, in order to accomplish the intended thrust, a shift in government procurement has to take place where bulk leasing has to decrease while application-based spending has to increase. For the FCSA, funds spent towards Transponded Capacity have to decrease over time, while spending on Subscription Services and End-to-End or Custom Services has to increase.

In NSR’s latest market study, Government and Military Satellite Communications, 8th Edition, capacity demand based on 36MHz transponder equivalents show these very trends. However, NSR sees two trends that may not lead to a quick spending transition that ultimately leads to substantial cost savings:

- Bulk Leasing is likely to continue to increase until 2015 before decreasing beginning in 2016;

- Bandwidth demand to support specific applications only begins to outpace the bulk leasing market in 2019.

In other words, the shift in procurement and spending will likely be incremental rather than radical. The finding is not surprising given the following circumstances:

- The U.S. is currently continuing its operations in Afghanistan where drastic shifts in contract vehicles could disrupt ongoing missions;

- With the drawdown in Central Asia, the Pentagon’s “Pivot Strategy towards Asia,” which shifts demand from CENTCOM to PACOM, will need to quickly ramp-up its capacity needs in Asia where mission requirements are still not clear. The best vehicle to quickly prepare for impending but yet-to-be-defined needs is to procure bandwidth via bulk leasing, which provides flexibility.

- Finally, it comes with the territory that government procurement has inherent bureaucratic mechanisms that makes radical shifts less probable.

It should be noted as well that NSR’s capacity forecasts are not just for the U.S. DoD but for all military entities around the globe. As such, the slow pace in the procurement shift in order to achieve cost savings and efficiency is not just a U.S. but a global phenomenon.

Bottom Line

Overall, despite expected delays in FCSA issuance of task orders and the slow pace in instituting change, the FCSA’s feature to make the process more competitive should ultimately lead to the savings envisioned by the contract vehicle’s original intent. Large vendors such as Boeing are also trying to get into the FCSA schedule and currently have a partnership with Artel. Over time, NSR foresees cost saving results due to the relatively large and perhaps growing number of players that are participating in the FCSA.

For vendors and service providers, competition and the thrust towards cost savings and efficiency could mean narrower margins over the long term.