|

In January 2012, an agreement to buy shares in the U.S. Wideband Global Satcom (WGS) was signed by Canada, Denmark, Luxembourg, the Netherlands and New Zealand. The agreement enables immediate access to WGS capacity in exchange for financing the WGS-9 spacecraft. Moreover, a WGS-10 satellite is expected to be contracted soon.

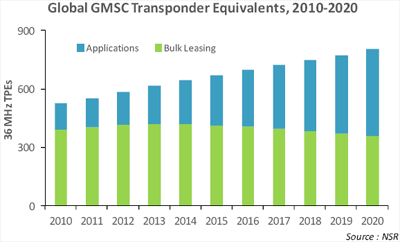

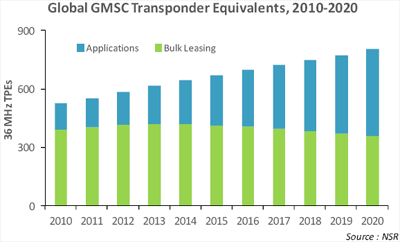

Each WGS satellite carries 4.875 GHz of capacity and when all 9 WGS satellites are deployed, the system would amount to 43.9 GHz of capacity or close to 1,000 36 MHz transponder equivalents (TPEs). At first glance, the large addition of internal, proprietary military capacity looks to impact the commercial SATCOM market negatively, particularly at a time when the U.S. and its allies are beginning to pull out of Afghanistan.

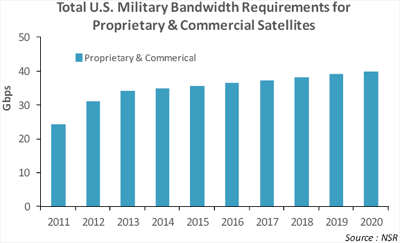

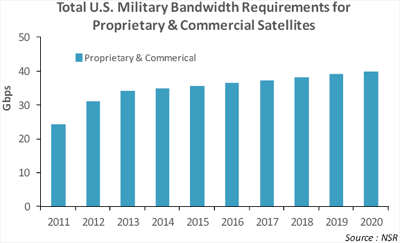

Upon closer examination, however, NSR foresees continued, albeit slower growth compared to the past 5 years, for commercial SATCOMs. Here’s why: Based on the U.S. DoD's projections and NSR’s estimates of U.S. Military requirements, by 2020, demand will be at least 40 Gbps, a requirement that will put pressure on WGS supply. As nations share in WGS use, supply constraints will be further exacerbated. In the WGS-9 agreement, the five nations will contribute a combined $620 million of the total $1 billion to build, launch and operate WGS-9 over 14 years, and the remaining funding requirements will be paid for by the DoD. But it is important to note the program sharing scheme effectively cuts the available capacity for use by the U.S. Military.

In addition, the various WGS satellites have different coverage areas. The location of hotspots is unpredictable, so WGS capacity will be limited by their respective footprints. Basically, not all of the 43.9 GHz of WGS capacity is or will be available in a given hotspot, whether already in existence or about to take place. WGS deployment will also be staggered such that supply increases are still playing catch-up to demand gaps. Four are currently deployed, and the remaining 5 will be launched starting in 2013 with WGS-9 scheduled for 2017.

One of the biggest factors in the bandwidth equation is usage by the intelligence community such as the CIA, NSA and international agencies, which will greatly impact demand. In an “Other Military” category released by DISA, up to 25% of total commercial capacity leased is used by organizations that include the U.S. intelligence community, and their use is projected to grow over time.

Moreover, non-military use that is increasing in the civil government side such as Homeland Security, DEA, border patrols using UAVs and Coast Guards (among others) would have to be accounted for. Redundancy, reserve and back-up capacity will likewise have to be included. The natural progression of increasing bandwidth requirements per terminal, soldier and other units will also have to be included in the overall bandwidth equation.

Finally, other frequency bands for form factors such as handhelds, which will likely switch from narrowband to wideband to broadband requirements, cannot run on WGS frequencies because of small antenna system requirements. Terminal availability that catches up to WGS deployment, which involves prototype development, testing, certification and others will experience delays so the need for other frequencies, including commercial frequencies, will continue.

Bottom Line

In 2006, the U.S. DoD released a program that included the deployment of WGS, AEHF, MUOS and the most ambitious program of all, TSAT, which together were envisioned to support 45 Gbps of bandwidth usage by 2020. In the program’s mix was substantial participation by commercial SATCOMs and covered a scenario where unmet requirements and an uncertainty in growth meant reliance on the commercial SATCOM industry to bridge the gap. TSAT has been cancelled, but the procurement of additional WGS satellites appears to be the strategy of achieving the 45 Gbps target where a WGS-10, 11 and 12 may be ordered in the future.

However, based on evolving mission requirements and use of technology, particularly UAVs, it is NSR’s view that the 2006 benchmark of 45 Gbps needs to be adjusted higher for the U.S. Military and intelligence community. Moreover and more importantly, as other nations provide higher participation in peacekeeping efforts, higher demands on proprietary U.S. military satellites should lead to continued growth for commercial SATCOMs in order to bridge the bandwidth gap.

On the WGS specifically, WGS-1, 2 and 3 appear to be already over-subscribed, and it will not be surprising to see reports that the recently launched WGS-4 may be quickly overburdened as well. Meantime and despite the WGS launches, growth on commercial frequency leases has continued at a steady pace. In NSR’s view, despite the deployment of military capacity, commercial bandwidth needs will continue to grow.

|