|

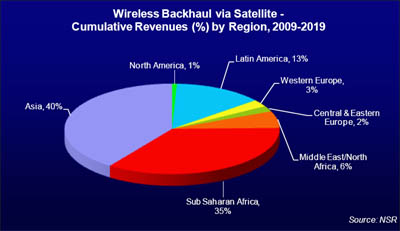

Wireless backhaul represents a massive market for satellite capacity worldwide; generating hundreds of millions ($) in lease revenue over hundreds of transponders. However, competition is ever on the rise against increasingly prevalent terrestrial and wireless backhaul options that offer a generally lower cost solution “when available”. Beyond mere connectivity are applications, and satellites are assessing all value added services in order to maintain and grow the backhaul business. Is mobile banking one such promising application?

The Mobile Banking Opportunity

According to the GSM Association, mobile banking began to emerge in 2004 in the Philippines and South Africa, where 8.5 million and 4.5 million people, respectively, use such services today. Mobile banking in rural areas has been ushered in partly by assistance from government agencies such as USAID for programs like the Micro-enterprise Access to Banking Services (MABS) in the Philippines, which began in 1998. These initiatives help alleviate poverty in areas that are in desperate need of financial services, and MABS in particular assists rural banks to provide loans, deposits, micro insurance, remittances, and mobile phone banking to micro-entrepreneurs, small farmers, and households.

These efforts have certainly paid off and today, commercial banks have on their own pushed for mobile banking services not primarily to usher in rural development to help the poorest of the poor, but to serve more natural motives that are in line with the banking industry’s interests: customer acquisition and maximization of profits.

So where does satellite backhaul fit into the picture? It fits in very well as a “killer application” appears to be forming in satellite technology’s most natural market base: the un-banked and under-banked populations of the developing world.

Currently, about 40 million people use mobile banking services worldwide, with the fastest growth taking place in Asia and Africa. The highly developed North American and European regions actually use mobile banking services minimally, and this trend does not appear to be changing over the long term as online banking, or the use of a computer instead of a cell phone, is the preferred mode for remote banking services in many First World countries. But in the developing world, the emergence and growing role of mobile banking using highly affordable cell phones is effecting a large and positive transformation in emerging economies where backhaul services will be key in continuing to enlarge the territories and populations that banks are looking to tap. The GSM Association estimates that one billion consumers around the globe have a mobile phone but have no access to a bank account.

The good news is this is beginning to change, and the change could take place at a highly rapid pace. In India, U.K.-based Monitise recently launched a joint venture with Visa to accelerate the delivery of mobile financial services to consumers. India’s 600 million working population have mobile phones, but only 200 million (or a third) have bank accounts. China’s telcos, which have more than 730 million mobile phone subscribers, are forming alliances with banking institutions to bring mobile e-commerce. And in Africa, the GSMA indicated that there are 18,000 new mobile banking users per day in Uganda, 15,000 in Tanzania and 11,000 in Kenya.

Bottom Line

- Satellite technology backhauling mobile banking services for the un-banked and under-banked in unserved and underserved areas is a unique and compelling value proposition.

- An emerging opportunity exists in mobile banking given the market numbers outlined above in key countries. However, partnerships with telcos and banking institutions (and even perhaps government agencies such as USAID) need to be formed by the satellite industry in order to fully take advantage of such opportunities.

- Apart from partnerships, cost considerations in terms of a satellite-based backhaul solution need to be addressed as banks that look to the “bottom line” in terms of CAPEX and OPEX need to justify ROI before fully embracing satellite technology as part of their core mobile banking networks.

|