|

6 July 2010

Peruse recent contracts for VSAT networks, and a notable trend stands out: various classes of government-backed networks and services by far dominate the market through the first half of 2010 and even well back into 2009. Be it emergency communications services for U.S. states or Chinese telcos, school network projects in Africa or India, or rural connectivity for USO in Indonesia or Colombia, government-backed projects of one flavour or another accounted for a significant majority of the VSAT business over the last six months.

While anyone involved in the VSAT industry has long understood the importance of these government projects, what makes them stand out so far in 2010 is the relative lack of classic corporate VSAT contracts. Yes, various niche applications like maritime and mobility are fairly well represented, and NSR is not claiming that no corporate contracts were signed. Still, the mix of clients is very much weighted towards the government sector, and this begs the question of whether this is the beginning of a concrete trend in the industry or simply a sign of the times.

Supporting the “sign of the times” argument, it would seem normal that the economic malaise of 2009 would still be apparent into 2010 as it takes time for corporate clients to ramp up VSAT network spending after pulling back in the last year. The pure play corporate market could well regain its position in the industry over the second half of the year and into 2011. Further, governments typically did not cut back on spending in 2009, and even bolstered spending with stimulus funds, such that it is not surprising that government-backed projects are filling 2010 order books.

Conversely, NSR noted in its Broadband Satellite Markets, 9th Edition study that the corporate markets in most developed countries, while significant, are tending towards saturation with most of the growth coming from renewal and extensions of contracts, upgrades to hybrid networks, and penetration into specific niches. In fact, VSAT service providers have moved away from the pure “VSAT” play over the last five years or so and have become much more generalized networking service providers. This is best illustrated by the January 2010 contract Spacenet signed with Regis Corp for a 7,000-site North American network that is entirely terrestrial-based. In developing markets, corporate clients continue to account for a significant minority of the business, but it is government projects that tend to make or break the business for most service providers.

The Bottom Line

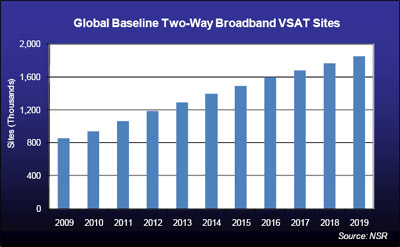

As illustrated above, NSR expects that the industry will see constant gains in the installed base of two-way broadband VSAT sites, regardless of the original source of demand. Yet, NSR would argue the days when pure corporate plays were the bedrock segment of the industry may well be past and it is now the government sector, either through direct investment or through indirect channels such as universal service obligations, that will be the most critical market segment for growth in the coming years.

|