|

Will LEOs Create a

Trillion-Dollar Industry?

August 28, 2019 by Lluc Palerm-Serra | NSR

The Space industry is progressively attracting more

interest from the investment community. In fact,

investment banks including Morgan Stanley, Goldman Sachs

and Bank of America Merrill Lynch expect the Space

industry to grow to over $1 trillion by 2040.

Expectations from private investors are not far behind,

Jeff Bezos justified the investment in the Kuiper

constellation based on the potential for it to “move the

needle” for Amazon, a company generating annual revenues

of $233 billion USD.

Is the addressable market big enough to support these

projections?

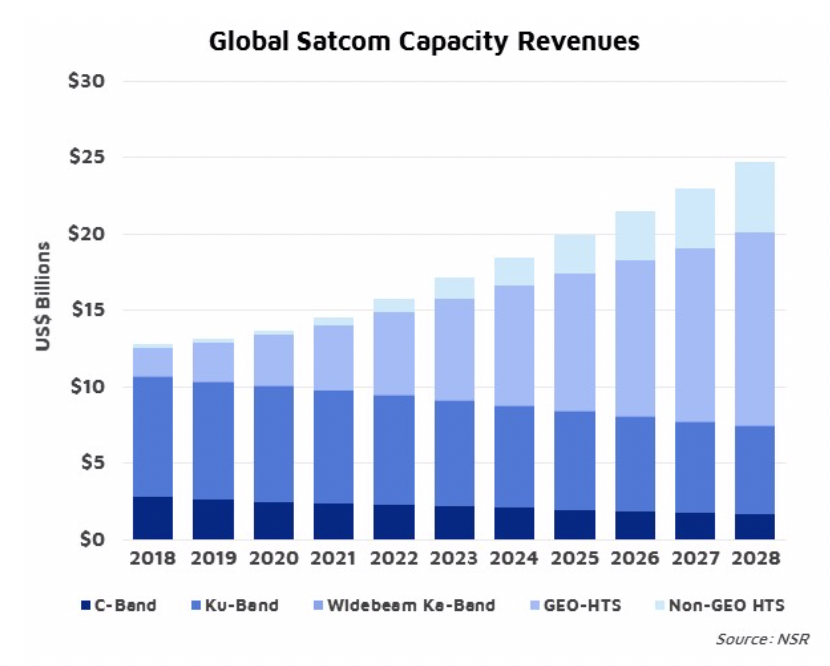

The satellite communications industry and its derived

applications (DTH, Consumer Broadband, Backhaul,

Mobility, etc.) has historically been a big portion of

Space revenues and would need to contribute to future

growth to reach those market potentials. According to

NSR’s

Global Satellite Capacity Supply and Demand, 16th

Edition report,

Satcom wholesale capacity revenues will reach $24.7

Billion by 2028. Assuming the same 6.8% CAGR as in the

2018-2028 period, the industry would generate $54.5

Billion annually by 2040. Even adding in

elements such as satellite manufacturing, launch and

ground equipment, the total is a good distance from the

$1 trillion projection. Given this, are there any

hidden use case that could boost the industry to a

trillion-dollar Space economy?

The Expectations from the Investment Community

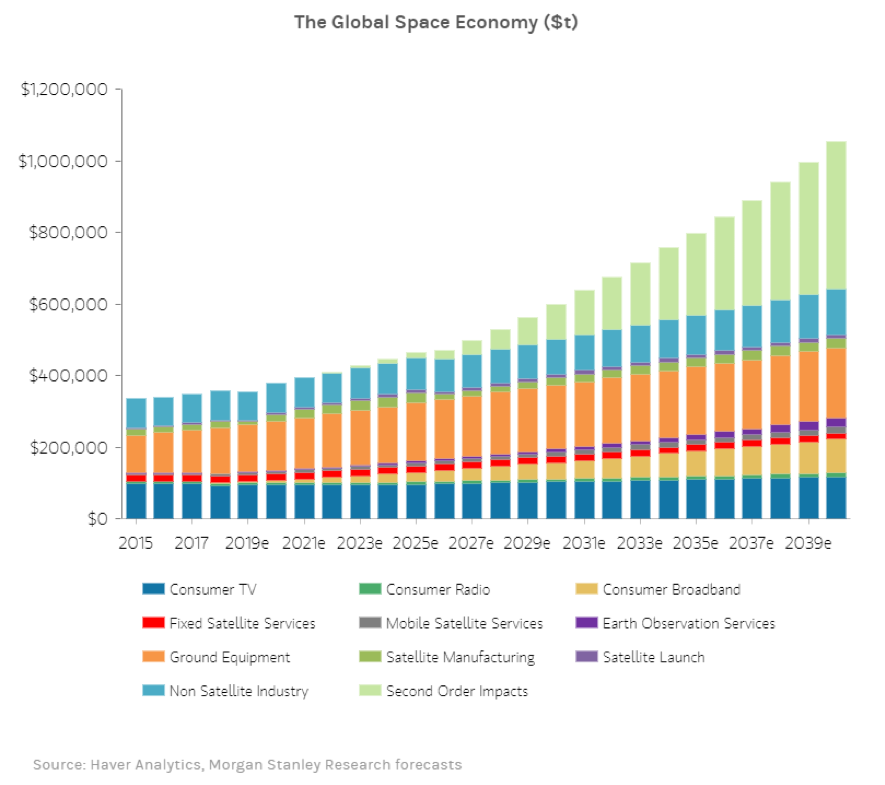

As per Morgan Stanley, the main source for growth for

the Space industry, apart from Second Order Impacts,

will be Broadband. The investment bank expects the

vertical to become a $95 billion market by 2040, growing

from somewhere in the neighborhood of $2 billion today.

While NSR agrees on the fact that many Satellite

Broadband use cases are still underpenetrated today,

stimulating demand has not been easy and sustaining high

growth rates over decades could exhaust the addressable

market.

Connecting the Other Half. Really?

“Connecting the other half of the population”

referencing to the fact that

50% of the population remains unconnected is a

recurrent motto within the satellite industry. However,

NSR believes the addressable market is significantly

smaller. The

Broadband coverage gap “only” represented 10% of the

world population according to GSMA. When one also

weights in other factors such as available income or

digital skills, the potential market for Satcom can be

defined realistically.

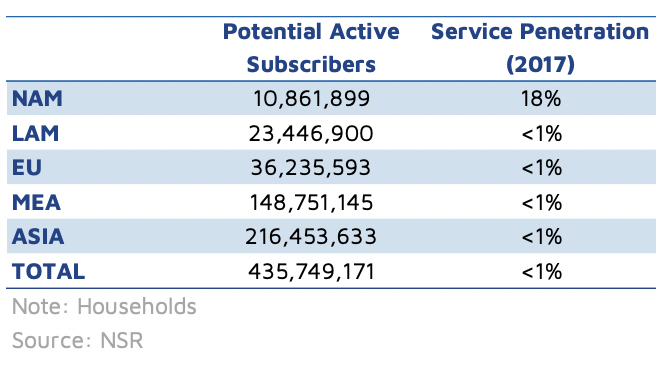

Based on estimates developed on NSR’s

VBSM17 report,

the addressable market for Satellite Consumer Broadband

accounts for 435M households. Service

penetration outside North America is still at minimal

levels, and NSR projects solid growth coming from this

vertical. However, one must bear in mind that revenues

per user extracted in emerging markets will be

significantly smaller than the $84.26 ARPU that ViaSat

realizes in the U.S., and NSR estimates a global average

ARPU (considering users connecting through Wi-Fi

aggregation points) in the neighborhood of ~20 USD by

2028. This yields a

total market potential of $104 billion. This is

the theoretical roof of the market, but NSR considers

the realistic opportunity to be smaller than that given

existing challenges such as the “usage gap”, the

difficulties in creating distribution channels or

competition from alternative technologies.

It Is Not (Only) About the Bandwidth

No one can deny how impactful digital inclusion is to

enhance the economy and wellbeing, from better education

and healthcare to more efficient companies and greater

market opportunities. An important concept is sometimes

referred to as “digital spillover”, when technology

accelerates knowledge transfer, business innovation, and

performance to achieve a sustainable development and

economic impact. Huawei estimated the digital spillover

to have an impact on the GDP x2.5 times larger than the

actual investment in digital assets. In fact, Morgan

Stanley estimates that over $400 billion from their $1

trillion Space-economy from 2040 will come from “Second

Order Impacts”.

NSR acknowledges that there are multiple use cases that

could be enabled by Satellite connectivity. For example,

as observed in

BDAvS3 report, satellite big data could generate

$17.7 billion in 10-year cumulative revenues by 2028.

Consequently,

it won’t come as a big surprise that the big supporters

of LEO constellations are at the same time strongly

positioned to capture opportunities in these “Second

Order Impacts”. From connecting Self-driving

cars, delivering truly ubiquitous cloud services or

enhancing communications cybersecurity, actors like

Softbank, Google or Amazon could greatly benefit from

seeing LEO constellations become operational. Some

established actors are anticipating this transition and

trying to capture a portion of these additional

revenues, for example SES forging a collaboration with

IBM Cloud.

Bottom Line

From a thriving startup ecosystem to ultra-rich

individuals investing in the industry or investment

bankers valuing the Space economy in trillions of

dollars, Space is increasingly enticing for investors.

However,

one must not be carried away by Silicon Valley dreamers

and do a balanced analysis of the market opportunity.

Markets like Consumer Broadband have created enormous

expectations but, while it is true that the addressable

market is massive and the opportunity is still largely

untapped, stimulating demand presents its own challenges

and NSR is more cautious projecting the growth of the

vertical estimating revenues in $17.3 Billion by 2027,

or what is the same, 16.6% market penetration over Total

Addressable Market.

While raw bandwidth is being commoditized, our increased

dependence on digital technologies is opening (in

parallel) sizable opportunities for value added

services. In fact, the

big investors behind LEO constellations are very well

positioned to benefit from these second order impacts of

ubiquitous connectivity.

Subscribe to talksatellite weekly newsletter -

circ@talksatellite.com

|