The Changing Satellite

Supply Chain

September 8, 2021 by Hussain

Bokhari | NSR

The COVID-19 pandemic triggered

a slowdown of most operational activities along the

satellite manufacturing value chain. In the early

pandemic days, manufacturing facilities had to put

their activities on hold, and launches were delayed

due to the interdependence of actors in the supply

chain from both sides and the restraints put on

personnel movement.

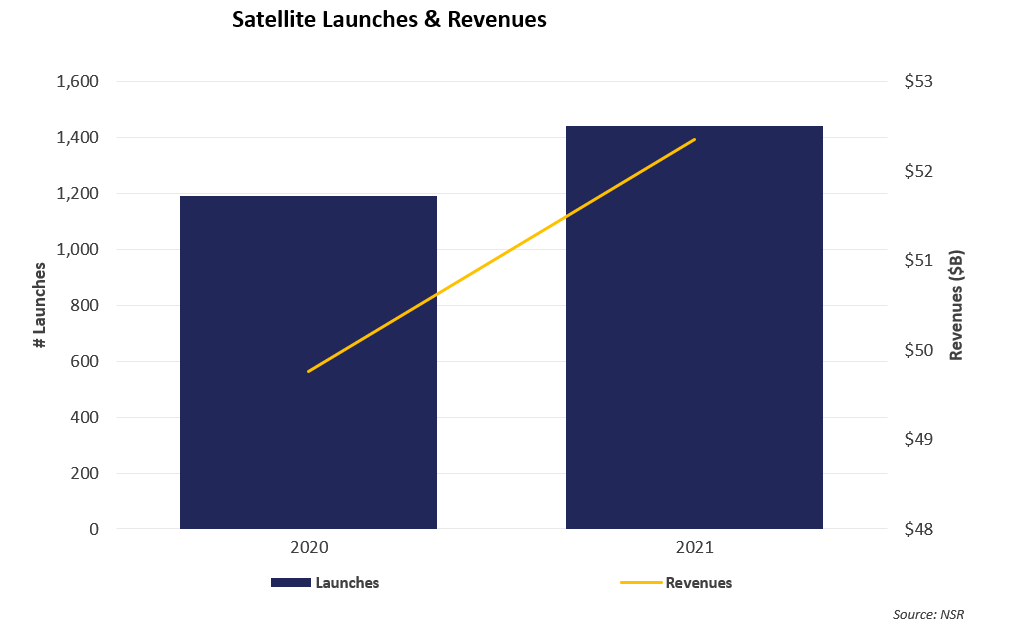

This had an impact on revenues,

and NSR Global Satellite Manufacturing and Launch

Market, 11th Edition report shows that 2020 orders

and launches were pushed to 2021 and potentially

beyond. Indeed, an increase ~250 more satellites to

be launched this year (vs. 2020) is expected, with

overall revenues associated with the Launch and

Manufacturing Markets expected to rise by $2.4B. The

gaps in commercial revenues created throughout the

pandemic are expected to be filled via government

and military orders and via operators getting ahead

of expected delays by pulling forward project

planning cycles.

For many organizations in the

value chain, starting at the component supplier

level, reaching all the way to satellite & launch

operators, they continue to suffer the rolling

effects. With launches delayed due to shortage in

liquid nitrogen, and SpaceX and other launch players

experiencing propellant diversion from launch pads

to hospitals, there are now concerns as to whether

the supply chain has been robust, financially

secure, and ready to mitigate risks under uncertain

circumstances.

In-House Model

Despite this, there is

sustained demand for satellite services, and mission

operations have been preserved and facilitated

through remote working and workaround with split

teams onsite. The market saw a large uptake in

funding due to renewed financing vehicles such as

SPACs and extensive venture capital invested that

strengthened the space value chain. And this extra

liquidity created a new path to innovation that many

manufacturers have taken in-house. Some satellite

operators (especially new entrants) have improved

their skills on advanced manufacturing techniques,

and taken the leap to move their manufacturing

operations in-house and cut out the middleman.

This new operational mechanics

have transformed the demand expected to be serviced

by major component suppliers. With the sheer demand

by new operators set to increase, capacity has led

to an overburdened supply chain.

The ambitions of manufacturers

have also created a gap in the launch market – with

the pandemic continuing in some places and

unavailability of key components increasing risk in

matching the launch cadence required in the coming

quarters. Due to continued obstacles in the supply

chain – companies like SpaceX, Arianespace, ULA,

Rocket lab, and others are undertaking new business

models to stay above deep waters by building new

relationships with suppliers directly, while

simultaneously focusing on acquisitions to reduce

disruptions and fasten the revenue generation. In

simple terms, the value chain is already undergoing

a consolidation cycle, which will continue in the

coming years.

Bottom Line

The rise of satellite order and

launch demand, for the sheer numbers in Non-GEO

alone, has led to new cracks in the industrial

supply chain. The COVID-19 pandemic revealed issues

in the supply chain: at the beginning, it was the

extensive use of teleworking, industrial and launch

site shutdowns, lower-level disruptions both in

supply chain and in working, payment delays and

orders between customers and companies.

However, as the pandemic

continues – the layers of issues continue to unfold

with many delaying launches by several months,

leading to reduction and in some instances a halt in

earnings for major companies.