Has The Space Spac Train

Left The Station?

April 22, 2021 by Arthur Van Eeckhout | NSR

The U.S. stock market is on

its longest bull-run in history, which began in

2009. A decade later Virgin Galactic’s reverse

merger with Social Capital Hedosophia raised

$800M for the Space Tourism company, signaling

the beginning of an extraordinary run in space

investment.

The significant increase in

investment activity for space can partly be

explained by the continued cheap access to

capital due to low interest rates and a sign of

a maturing NewSpace ecosystem as more VCs exits

from early stages. As discussed in NSR’s

Emerging Space Investment Analysis, 3rd

Edition, a surprising number of deals happened

through a little-used investment vehicle known

as a Special Purpose Acquisition Company (SPAC)

to accelerate IPOs of launch, Earth Observation

and satellite communications start-ups.

But cooling signs already point to

investor fatigue in the vehicle with a

significant decrease in recent SPAC filings as

well as SEC investigations taking place. Does it

signal that the space SPAC train left the

station?

A Year to Remember

2020 was promising and will

be known as the year of space M&As. Voyager

Space Holdings and Redwire acquired several

NewSpace companies in a vertical integration or

roll-up strategy, with Redwire now going through

a SPAC of its own . Exits being historically

rare in the industry, the last two years have

offered a strong contrast to what was considered

the norm.

For investors, increased

exits will spur and reaffirm their investment

beliefs. Near-term, the impact of the recent

flurry of SPACs will be felt by entrepreneurs

soliciting VC funds. SPAC players are unlikely

to raise more funds in the near term, which

should leave VCs with more money to invest in

other promising space ventures.

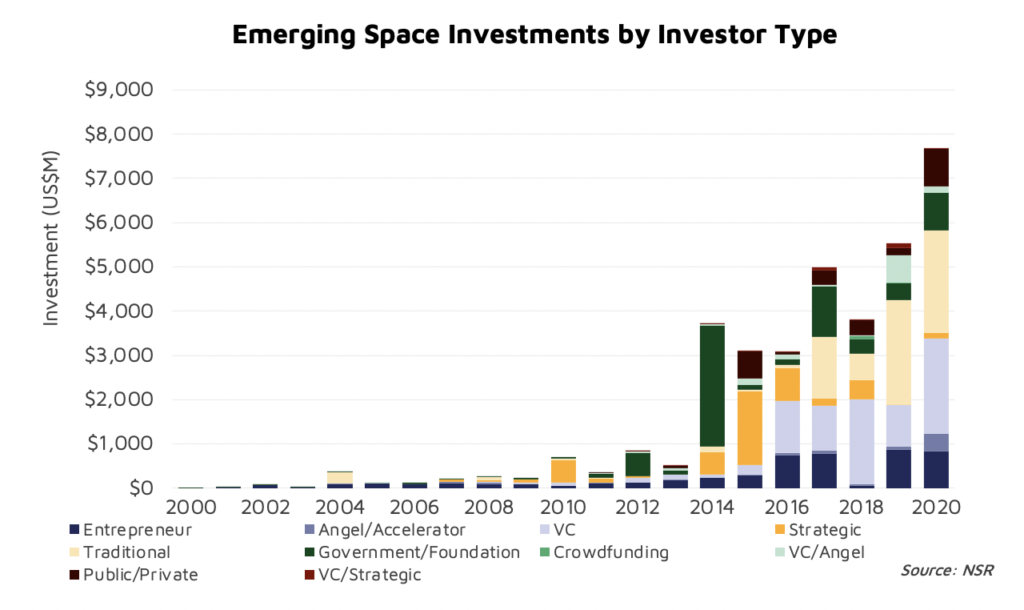

As a result, the type of investors we are

seeing in space is growing and thus, the space

SPAC investments may be a telling sign the

industry is maturing in the eye of those with

money to invest (See Figure 1).

SPAC advantages are speed

in relation to the classical IPO route and the

ability to raise a large amount of funding at

low dilution. Of particular note, those involved

in the industry claim being a publicly traded

entity brings additional credibility and

facilitates dealings with the space industry’s

main customer: the government.

More evidence of the

maturing NewSpace ecosystem and the capital

employed can be seen in the break-down of the

space verticals represented in the companies

undergoing SPAC. The launch business, space’s

most capital-intensive vertical and overall

enabler, raised $4B in 2020, dominated by

investments in SpaceX and Blue Origin. In

comparison, Astra aims to raise $489 M and

Rocket Lab has earmarked $750M through their

respective SPACs.

Emerging players in the

Earth Observation market raised $677M, with

Spire and BlackSky counting on a combined sum of

$920M through their reverse mergers. Finally,

the connectivity market, a major battleground

for OneWeb, Elon Musk’s Starlink and Jeff Bezos’

Project Kuiper, saw emerging space player raise

$360M in 2020. In comparison, AST SpaceMobile

expects to raise $462M in gross proceeds from

its reverse merger.

Risky Business?

With all this money going

to an industry that is usually reserved for the

few savvy venture capitalists, opportunities for

retail investors through these SPACs is unique,

as they are usually excluded from space deals

due to lack of access. With

increased visibility for the industry, they have

more options now to invest in space, such as

through the recently released Space ETF ARK

Space Exploration & Innovation exchange traded

fund and the NewSpace SPACs. Thus, they form a

new breed of fresh funding resources that can be

tapped in capital markets.

However, the risk associated with SPACs needs to

be taken seriously, in particular when it comes

to the evolution of the company’s valuation

often based on wildly optimistic revenue goals.

One notable criticism of SPAC is its use as a

pump and dump scheme (the most recent example

being Quantumscape). Moreover, the market can be

unforgiving when revenue and profitability

expectations are not met, compounded by the

difficulties the industry would face if the

economy were to slow down.

Bottom Line

Cheap access to capital

made 2020 a memorable year for space investments

and has jump started 2021 with SPAC

announcements. Emerging Space investments today

are a 10-year overnight success story, when

seeds were planted long ago, required continuous

cash infusion and relentless innovation on

multiple fronts to close business cases.

The record raise of 2020

should add more fuel to the fire of investment

in space companies, part of a future expected to

generate $1 T by the end of this decade. NSR

expect investors to show continued confidence

and support regardless of the SPAC frenzy, whose

impact on the industry will be clearer within

the next few years. But in

the meantime, should interest rates rise, the

SPAC opportunity weaken, and some VCs continue

to exit, there is a risk for some space

companies that the SPAC train of large funding

rounds with low dilution might have left the

station already.