Constellations:

Accidents Waiting To Happen?

April 14, 2021 by Dallas Kasaboski NSR

Last week, two major

constellations operators,

OneWeb and SpaceX, nearly crashed in space, when

two of their satellites almost collided.

Another near-miss happened the same day

when two other satellites nearly struck each

other over the Arctic. And last month, the 2-ton

NOAA-17 satellite broke up, sending dangerous

debris all along its orbit.

This type of space debris and close calls are

becoming too common, especially as more

satellites are launched, and space junk, even

from decades ago, persists and compounds the

problem.

Space Situational Awareness

(SSA), the commercialized service of monitoring

orbit and warning operators, maybe the best

market response to this litter challenge.

Yet, while the risk and opportunity grow

daily, the SSA market lags. Fractured

coordination, capabilities, offering, and

pricing structure, and long-established low

priority affected to cleaning up space is such

that SSA struggles as any emerging market does

with a solid perception that “if it ain’t broke,

don’t fix it”. Furthermore,

it presents different views on the danger of

debris, and the necessity of its services.

And lastly, it suffers from far smaller

funding and budget than is provided to

constellations. However,

while constellations may appear crucial,

especially to certain investment and bottom

lines, SSA is, in fact, crucial to the safe and

sustainable use of space to avoid constellations

from becoming accidents waiting to happen.

So, why is the SSA market

lagging, what impact will that have on the

industry, and what can be done to change the

situation?

Government Play or

Commercial Opportunity?

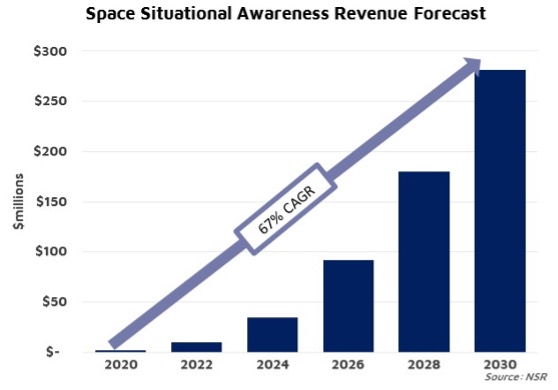

NSR’s In-Orbit Servicing &

Space Situational Awareness Markets, 4th Edition

(IoSM4) report forecasts SSA services to grow

from just $2 million to $282 million in annual

revenues between 2020 and 2029.

While that seems impressive, NSR also

forecasts that SSA players will only capture 20%

of the serviceable addressable market during

that time. In other words, out of every 5

high-risk satellites operating over the next

decade, only 1 will be actively monitored and

tracked, with warnings provided to its operator

by a commercial provider.

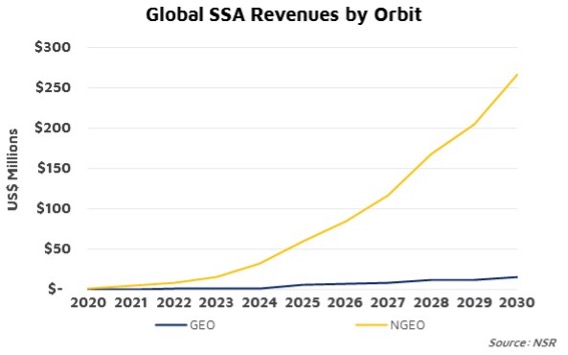

Competition with government

programs is one reason behind this trend.

Increased funding and development of programs,

such as the U.S. Space Fence, JAXA’s SSA, and

the EU Space Surveillance & Traffic (EUSST) will

challenge the commercial market through the

capabilities and services offered. Additionally,

the issues of dual-use, and splitting between

classified and non-classified data, muddy the

water and are expected to limit the commercial

play. However, given the high-strategic value of

the assets, government and military customers

are still expected to drive commercial SSA

market revenues, at 53% of the cumulative

opportunity over the decade, 95% of which will

be for non-GEO satellites.

While growing government

programs will bring greater monitoring

capability, a severe lack of coordination and

fragmentation of performance hold the SSA market

back, at best, and spell disaster for operators

in the worst case.

Worst Case Scenarios

Take the OneWeb/Starlink

near-collision. According to one report, Space

Force alerted OneWeb, who then contacted

Starlink to quickly create a mitigation plan.

For a reason yet unknown outside of SpaceX, the

company turned off its automated collision

avoidance system, allowing OneWeb to take full

control of the situation by maneuvering their

satellite away. There was no pre-arranged plan,

and coordination was handled last minute.

There is no central

governing authority for SSA or satellite

collision avoidance. Licensing regulations

remain fragmented, region to region, and

underdeveloped, failing to set minimum required

capabilities and standards. While it is

generally imprudent to fear that the sky is

falling, these incidents will continue, in

greater frequency, and one day, the worst-case

scenarios will unfold, and collisions will

happen. In the meantime, late coordination costs

money, through reactive avoidance maneuvers,

shortening satellite & revenue-generating

lifetimes.

There is hope here. Support

for SSA coordination has grown, such as through

statements made recently by the U.S. Space

Command who support setting international “rules

of behavior in space”. At the same time,

projects like IBM’s SSA, and Imagine LAB’s Eyes

on the Sky projects are aiming to crowdsource

and coordinate the development of SSA data and

monitoring capabilities. In the commercial

sector, partnerships such as between LeoLabs and

SpaceX serve to support and improve the

development of SSA services.

The Bottom Line

Space is full of junk.

Debris, defunct satellites and other objects

like rocket bodies as far back as from the first

few rocket launches remain a danger in orbit.

With constellations continuing to drive the

market, the chances of collision will only

increase. Space Situational Awareness is

necessary for monitoring and warning against

this risk, yet the capabilities and market

remain significantly fragmented and

underdeveloped. Coordination, collaboration, and

setting stronger standards for collision

avoidance will be necessary to move this market

forward. Otherwise, collisions, not

constellations, will be the main market outcome.