Pricing Elasticity in Satellite Broadband

Feb 27th, 2017 by Lluc Palerm-Serra, NSR

In the last several years, the satellite industry has witnessed severe price degradation, with satellite operators consequently suffering revenue readjustments. Lower $/MHz to orbit, new technologies on the ground, a fierce competitive environment… will continue to drive capacity pricing down. Is the industry shooting itself in the foot, or will there be new opportunities to unlock and generate revenue growth?

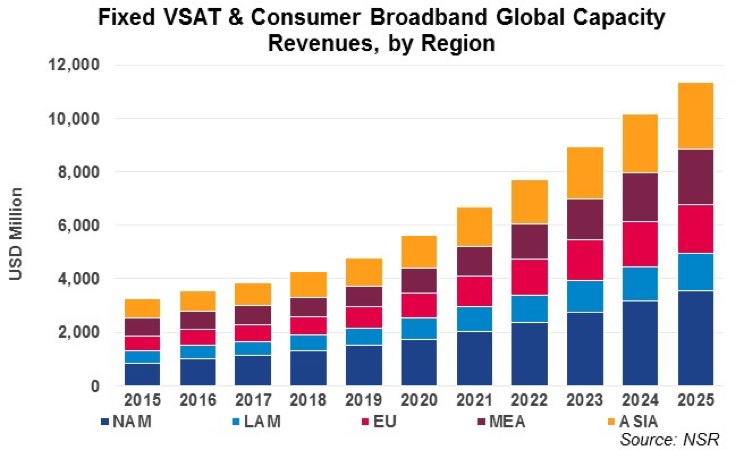

Despite this pressure on pricing, NSR’s VSAT and Broadband Satellite Markets, 15th Edition report forecasts capacity revenues for Fixed VSAT and Consumer Broadband to grow by a factor of x3.5 in the next 10 years, surpassing the $10 billion threshold by 2024. NSR is optimistic in the sense that lower price points, together with next-generation ground segment and the appropriate business models have the potential to unlock new business opportunities.

Elasticity in the Backhaul Vertical

One of the verticals generating high expectations is Cellular Backhaul, and very large deals have been announced during the last several months. Interestingly, these projects are coming both from developing markets, like the TIM Brazil-Intelsat deal announced last September, and developed markets, like EE-Avanti-Gilat in the UK. Lower cost of capacity is effectively opening new opportunities and creating new use cases for this vertical. 3G/4G services can now be economically backhauled via satellite, and decreasing the total cost of ownership allows deploying services in lower ARPU areas without incurring the high initial investment and risk of deploying ground networks. Let’s try to understand the details of this vertical in terms of demand elasticity.

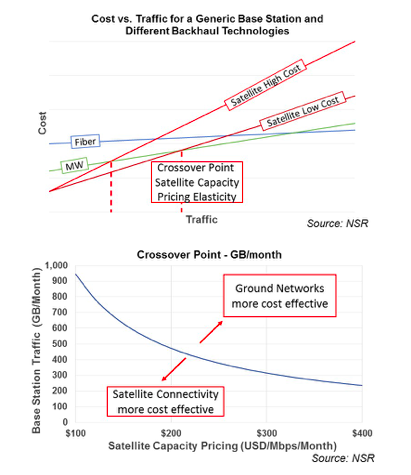

Given a generic Base Station, one could backhaul the traffic using a range of technologies. Fiber would have the highest initial investment (civil works, hardware involved etc.), but then the variable costs with traffic would be very low making it the technology of choice for high-traffic connections. On the other extreme of the spectrum is satellite, with low initial cost but high variable costs as the amount of traffic grows. Somewhere in the middle, ground microwave bridges the two solutions. If the cost of satellite capacity declines, the crossover point where microwave is more cost effective than satellite moves towards higher traffic. Making some assumptions for a generic site (this would need to be done in a case by case analysis), one could find the curve relating Base Station traffic and the satellite capacity price point that makes a satellite solution more cost effective than microwave. With the assumptions used by NSR to generate the graphs below, if a Base Station consumes 300 GB/month, satellite capacity cost below $300 USD/Mbps/Month would make the satellite solution more cost effective than any ground alternative.

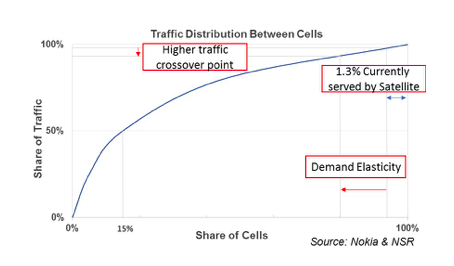

Declining capacity pricing has a very rapid effect on the amount of traffic at which a satellite solution is more cost effective than a ground alternative. Going one step further, this directly translates into higher levels of demand for Satellite Backhaul. Based on data from Nokia, 50% of traffic in the network is carried by just 15% of the cells with a long tail of stations carrying a relatively small share of traffic. Slightly increasing the crossover traffic at which satellite is more cost efficient than microwave will rapidly translate into higher levels of demand for SatCom.

Each Vertical and Region is Unique

The satellite industry serves a wide variety of applications. Each vertical and region has its own internal dynamics, and some will show great degrees of elasticity while others may be driven by other attributes. Even with lower price points, the Retail/Hospitality vertical has slow growth prospects in developed markets as the application is close to saturation and ground networks exert strong pressure in the vertical. Similarly, Energy markets are going through difficult times because of their own internal dynamics, and it seems difficult that lower cost of capacity will change that before the prices of commodities recover.

Conversely, the Consumer Broadband segment has shown great levels of elasticity and, with 3.9 billion people still not using the Internet, the prospects for growth are immense. Service uptake in the vertical takes off when the cost of the service falls below 5% of the available income. The challenge resides in that a big portion of the addressable market is formed by low income households and the industry needs to develop innovative approaches to unlock these opportunities. Lower cost terminals or Wi-Fi hotspots to aggregate demand are just a few of the strategies that will be needed for these “bottom-of-the-pyramid” markets. Additionally, one must not forget that one of the key barriers dragging the development of Consumer Broadband, even in developed markets, has been the existence of strong retail players. Low capacity pricing alone won’t stimulate market growth, actors willing to succeed in the vertical will need to find the right partners or invest in developing the sales channels.

Bottom Line

Capacity prices have declined significantly during the last couple of years. With new Ultra-HTS on the horizon, this trend won’t revert in the near future. The industry must find the applications and markets showing the greatest levels of elasticity in order to stimulate growth.

NSR is optimistic that lower pricing levels will unlock key verticals like Cellular Backhaul or Consumer Broadband, generating growth for the entire industry. New price levels are transforming satellite into a viable solution for 3G/4G Backhaul unlocking a series of new use cases. At the same time, Consumer Broadband continues to present a massive opportunity if the right price points and business models are hit.

In any case, one must not forget that low cost capacity alone won’t be sufficient to grow the market. The whole ecosystem needs to be developed, from efficient ground segment that can meet the IP requirements of today’s world, to a service offering adapted to Mobile Operator needs or a strong retail presence to reach the end-users in Consumer Broadband.