Military SATCOM: Where Are We Headed?

Nov 3rd, 2015 by Brad

Grady, NSR

Government & Military Satcom players gather in London this

week to discuss the industry and share ideas, what are the major

issues still afoot in this turbulent sector? With NSR’s

President Christopher Baugh chairing the conference second day

and providing a keynote address of where we see the market,

there are still numerous issues to face as government planners

address enabling communications across their organizations.

Using NSR’s Government and Military Satellite Communications,

12th Edition report, and a preview of NSR’s thoughts

in London, key issues to discuss include:

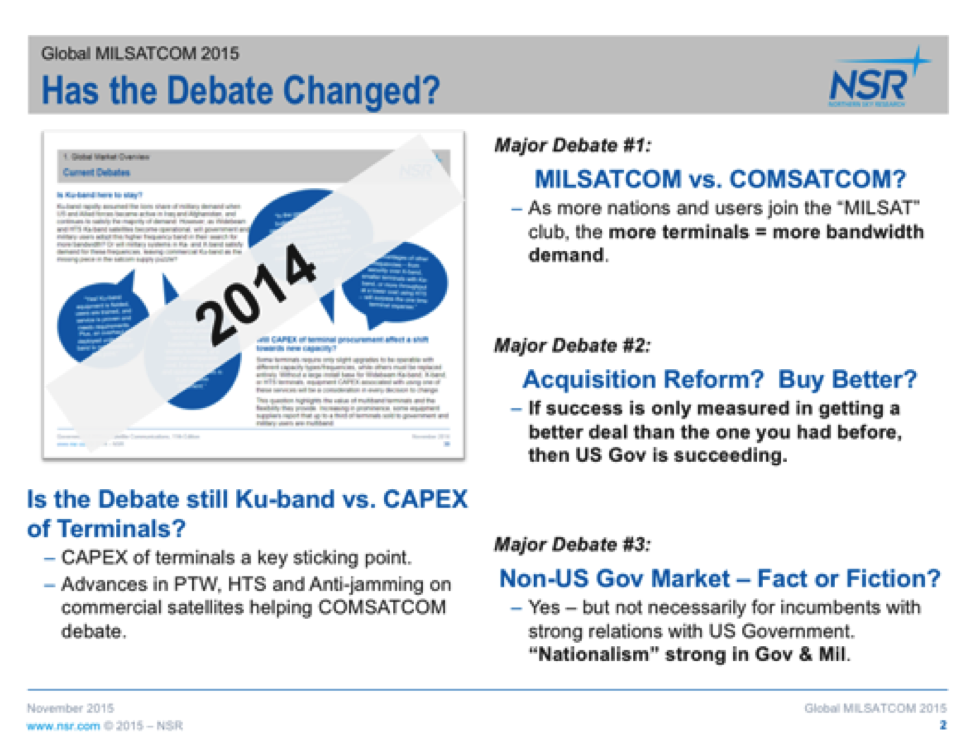

With a 2-year budget plan passed in the U.S., does that pave

the way for these ‘smarter acquisition’ paths such as the

Pathfinder Program or single purchasing entity consolidation, as

it relates to COMSATCOM utilization? We remain skeptical,

but at the least it might help enable action to develop a

clearer picture of the how and what is being acquired, and where

synergies might develop. Or, allow money to be allocated

to study the issue per-GAO’s recommendations.

For industry, it might mean some relief of extreme

pricing and competition pressures (and combined with the

flare-ups in the Middle East, Europe, and Asia... there might be

some new opportunities) – but we don’t assume a change to the

status quo…yet.

A critical, often forgotten component of the MILSAT vs COMSAT

debate, dedicated MILSAT terminals are frequently expensive,

face significant production delays, and are only now providing

flexibility in terms of their ability to connect to both COMSAT

and MILSAT networks. For the vast majority of

applications, a flexible approach to terminal programs that can

leverage whichever frequency, source, or architecture available

at the time provides the best service at the best price for

government end-users.

In the growing UAS market, that is likely to remain a

majority Ku-band play given the lead time for terminal

certification and installation. For Maritime and

Land-Mobile, other frequencies are easier to integrate into

end-user platforms. As Ka-band offerings from GEO-HTS and

MEO-HTS expand and come online, they will provide a compelling

value-proposition to government planners who have Mil Ka-band

frequencies available to them, and help support costly terminal

acquisition programs in a challenging budget environment.

More nations than ever before have joined the ‘space club’ in

the past five years – most with a focus on providing support to

their national security forces. For people in the

‘building satellites’ market, these national space programs have

been more positive than negative in government markets – at

least initially. Combined with a changing role of

the U.S. around the world, one might get the impression that

there is ‘easy money’ in emerging markets.

However, elsewhere in the value-chain, these programs have

created a complex operating environment of supporting national

capacity and space programs, integrating commercial

capabilities, and allowing industry to develop robust offerings

at competitive rates. With the rising ‘nationalism’ movement

within the Gov & Mil space sector, there might be opportunities

outside U.S./U.S.-Partner Nations – but, do not expect that

incumbent players have a unique advantage because they provide

services to the U.S. DoD or U.S. Partners.

This is perhaps the most contended, heated debate in Gov &

Mil circles. Beyond just the ‘who’s cheaper’ arguments on

the surface, it really gets to some of the core sentiments in

satcom strategy; Does commercial count towards ‘disaggregation’,

how secure or responsive can commercial really be, who do I

partner with for my MILSAT systems, and, what applications can

go where?

Although commercial capacity and commercial players are

increasingly being considered ‘part of the solution’, there will

always be competition between them. And, at the end of the

day, maybe some competition is a good thing for bringing better

solutions at better prices to support government end-users in

the field.

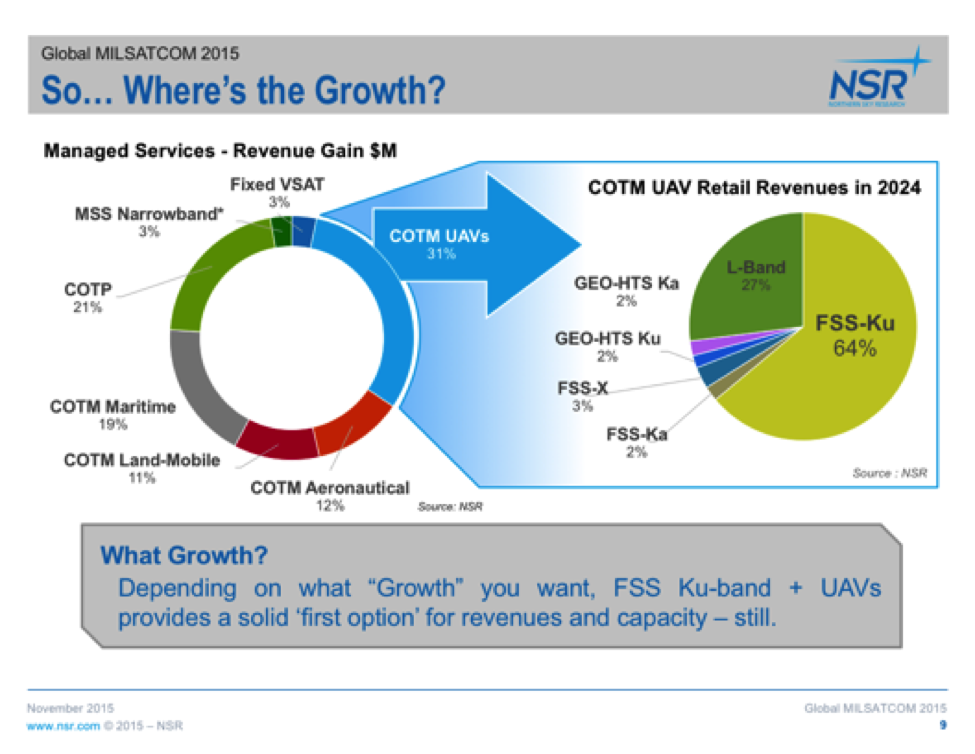

Overall, there remains a lot of skepticism and negativity as

it relates to Gov and Mil SATCOM markets. With the

changing face of military actions in the Middle-East, Europe, or

Asia and the move from troops on the ground to eyes in the sky –

is there a clear source of growth for industry going forward?

Short answer –Yes.

“Clear Winners”

Mobility at a top-level, UAVs in general, and FSS Ku-band

specifically will be key sources of growth for commercial

players over the next ten years. Followed by COTP land-mobile

opportunities across FSS, HTS and MSS; supporting Maritime

networks, and then Manned Aero will be key revenue growth

opportunities the industry needs to develop solutions to

support.

“Less Winning” Options?

Fixed VSAT applications and MSS Handhelds or other form

factors (MSS Narrowband segment in graphic) will be slower

growth segments from a revenue perspective. Although they

provide huge numbers of In-service Units, the changing face of

U.S. defense strategy continues to shift revenue growth towards

mobility segments supporting high-bandwidth segments and

applications.

Bottom Line

There is no more “easy money”. As Intelsat’s and other’s

annual reports point out, simply selling bandwidth to the U.S.

Government is not the money-maker it once was. The one good

thing? More terminals mean more bandwidth and if WGS is a valid

case study – military capacity alone cannot support these

emerging applications by itself.